Author: talupaWriter

-

Gold Prices Reach Record Levels due to Increased Safe-Haven Bids – KITCO News

In an unprecedented move, the gold market is witnessing a surge in prices that sets a new record high. Increased safe-haven bids amidst prevailing global uncertainties and economic volatility has led to this upward trajectory. Investors are increasingly turning their focus towards gold, traditionally seen as a ‘safe-haven’ during tumultuous times. This turn of events…

-

Silver Price Upholds 20-Day Support Despite Possible Pullback – FXEmpire

Despite facing threats of a downturn, the silver market has managed to hold steady in a 20-day support trend, according to FXEmpire. The precious metal market has remained buoyant, suggesting the potential for an upcoming pullback. However, investors should not be quick to bet against silver; resistance levels indicate a resilient market that is far…

-

Gold Price Peaks to Historic Levels – An Unprecedented Surge

In an unparalleled turn of events, the price of gold has surged to a new record high, symbolizing its absolute resilience and unwavering demand in volatile global markets. This esteemed precious metal has, once again, proven its weight in gold. This increase in price can be attributed to investors flocking towards safe-haven assets amidst uncertain…

-

JP Morgan Predicts Gold Prices to Soar Past $4,000 by mid-2026

According to Yahoo Finance, JP Morgan, a leading global financial services firm, predicts that gold prices will skyrocket to cross the $4,000 per ounce mark by the second quarter in 2026. This projection can be attributed to various factors like growing demand, geopolitical tensions and inflation rates, which accentuate the value of gold as a…

-

Wall Street Rebounds Amidst Hope for tariff Easing

Marked by a significant rebound, Wall Street echoes hopes for tariff easing after a period of market turbulence. The Dow Jones Industrial Average began showing a steady rise following up-to-date official reports, instigating a spark of hope among investors and reinforcing the belief that an era of tariff easing may be ushered in soon. Economic…

-

Evolution of Crypto Market Cap: An Analysis from 2010 to 2025

In the realm of digital currencies, the past fifteen years have been truly revolutionary. From being almost nonexistent in 2010, the crypto market cap ascended spectacularly, a testimony to the increasing acceptance and adoption of cryptocurrencies globally. The champion, Bitcoin, initiated this dramatic journey, and soon Ethereum, Ripple, and numerous others joined the league, contributing…

-

Cryptocurrencies Price Prediction: BTC, SUI, and Altcoins – Detailed Analysis for Crypto Enthusiasts

In the dynamic world of cryptocurrencies, predictions are a tough nut to crack. However, the recent trends provide some hints. The most dominating cryptocurrency, Bitcoin (BTC), currently showing signs of bullish trends. Its critical support level seems steady, stipulating potential for further upward movement.nn Swisscoin (SUI), a less renowned but promising name in the crypto…

-

Bitcoin Price Surge During Stock Market Fall – Analysing Today’s Crypto Economy

In an inverse correlation today, Bitcoin along with other cryptocurrencies are witnessing a surge while the traditional stock markets are experiencing a fall. This leaves many investors and analysts pondering on the reasons behind this phenomena. A key factor contributing to this scenario is the increasing acceptance and adoption of cryptocurrencies, given their decentralised nature.…

-

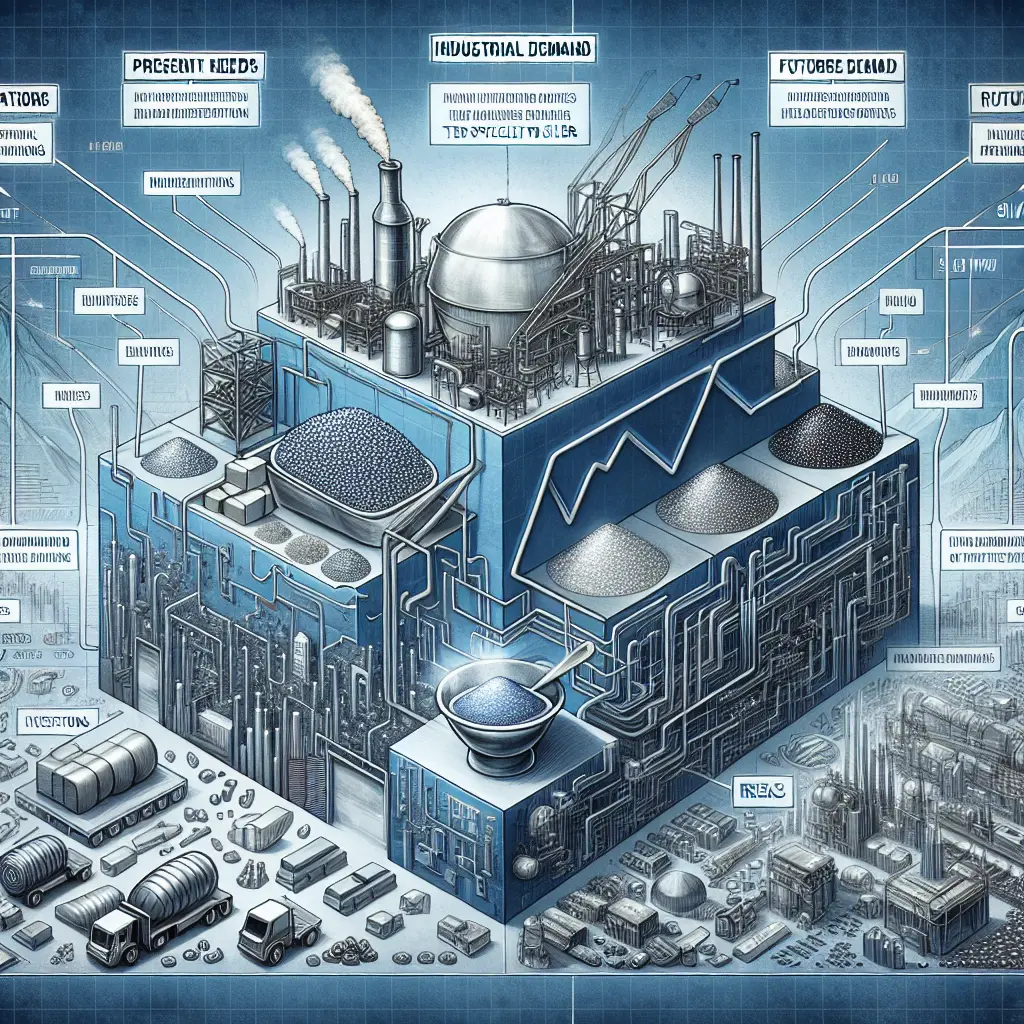

Industrial Demand Questions and Its Impact on Silver’s Price

As silver continues to play a crucial role in many industrial sectors, questions surrounding its demand could significantly impact its price. Silver, an essential component in multiple industries, from technology to renewable energy, is currently experiencing a speculative moment. While the demand for silver has indeed risen, speculation around its sustainability has also grown. Thus,…

-

Record-breaking Rise in Gold Prices Amidst Safe-haven Buying

On Monday, 21 Apr 2025, the gold market leaped to a record high on sustained safe-haven purchasing. This surge is largely attributable to investors finding solace in gold amidst turbulent market conditions. Notably, volatile stock markets and looming economic uncertainties have been instrumental in escalating gold’s appeal as a safe-haven asset. This unrelenting purchase has…

-

Gold and Silver Price Forecast Amid Tariff Tensions

The global marketplace is currently witnessing volatile changes as tariff tensions escalate, and the strength of the dollar ebbs. This precarious scenario has been serving as fuel for a rising demand for safe-haven assets among investors, most notably gold (XAUUSD) and silver. The heightened trade-related apprehensions paired with currency debilities have cast a shadow over…

-

Trump-Powell Clash Boosts Gold to $3,400 Amid Fed Independence Concerns

In the wake of the recent skirmish between President Donald Trump and Federal Reserve Chief Jerome Powell, the precious metal gold has soared past the $3,400 price mark. This unprecedented surge has reflected the heightened market worries over the Federal Reserve’s independence. Albeit known for their independence from the political machinery, recent actions and comments…

-

Gold Market Update: Prices Rebound Post-Weekend Drop

In an unexpected turn of events, gold prices staged a swift rebound following a record high-drop over the weekend. The yellow metal, considered a safe haven for investors, bounced back strongly on Monday from the weekend plunge, putting the gold market back on its positive track. This volatility is believed to have been triggered by…

-

Unprecedented Surge in Gold Prices Hits Record High – A WSJ Report

In an unprecedented turn of events, the price of gold has surged to another record high, according to Wall Street Journal reports. This surge in gold prices is indicative of market volatility and investors’ preference for secure investments amidst uncertain economic conditions. The rising demand for gold, a traditional safe harbor for investors, is a…

-

Forbes Top 10 Cryptocurrencies List for April 15, 2025

In the dynamic landscape of cryptocurrency, we have seen a striking shift towards altcoins in 2025. Here, we rank the top 10 cryptocurrencies that have made significant strides and are worth considering for investment this April. Bitcoin (BTC): As usual, Bitcoin remains the dominant force in the crypto market. Despite the volatility, its resilience and…

-

Best Performing Cryptocurrencies of 2025 – A Detailed Look at the Top 8

As we approach the middle of 2025, it’s time to take a look back and reflect on the Cryptocurrency market’s gains so far. This year, we’ve witnessed an unprecedented boom in the digital money realm. Among several sectors, the crypto market has experienced astounding growth, paving the way for a long list of promising cryptocurrencies.…

-

Crypto Market Cap Development: A Journey from 2010 to 2025 – Statista

Crypto Market Cap 2010-2025 – Statista Despite cryptocurrencies like Bitcoin and Ethereum being relatively young financial instruments, the crypto market cap has seen explosive growth since its inception. From a fledgling entity in 2010, it has grown to be a significant force in the global financial ecosystem by 2025. The advent of blockchain technology and…

-

Gold and Silver: A Precious Metals Opportunity Amid Global Economic Uncertainty | Rana Vig – The Jerusalem Post

Gold and Silver, the two most sought-after precious metals, are brewing up a perfect storm in the commodities market, according to Rana Vig. Their intrinsic value, coupled with global economic uncertainty, has created a unique opportunity for investors. As their demand soars, so does their price. Vig, a respected authority in the precious metals sector,…

-

Price Surge Anticipated Amid Persistent Silver Supply Deficit- Silver Institute 2025 Survey Reveals

Persistent supply deficit will drive silver prices higher – Silver Institute 2025 Survey – KITCO The persistent supply deficit has emerged as a driving force poised to propel the prices of silver even higher, according to the Silver Institute 2025 Survey, reported by KITCO. The continuous gap in supply and demand, which has been prevalent…

-

Bullish Breakout for Gold & Silver amid Tariff Chaos Fuelling Demand

The precious metals market is experiencing a significant upturn, ignited by the escalating tariff chaos worldwide. The heightened economic uncertainty has fueled an unprecedented demand for safe-haven assets, particularly gold (XAUUSD) and silver. Bulls are seen breaking out in both these sectors, initiating a positive forecast for their prices. The unsettling geopolitical tensions and the…

-

Unprecedented Gold Tumble Following ‘China Frenzy’

Easter Weekend Sees $3300 Gold Tumble from Fresh ‘China Frenzy’ High – BullionVault In an unprecedented event over the Easter weekend, the bullion market experienced a significant dip, with gold prices tumbling by $3300. This fall comes after a record surge to a fresh peak, largely driven by a craze in China. This ‘China Frenzy’,…

-

Gold Price Maintains Dominance: April 17, 2025 Financial Update

Given the current economic landscape, gold, a classic safe haven investment, continues to shine bright. With today’s pricing, the precious metal has demonstrated an impressive streak of strength and resilience. Analysts have noted a potential long-term bullish trend, contrasting the turbulent state of the cryptocurrency market. Rising inflation and geopolitical uncertainties have further bolstered gold’s…

-

Future of Gold Rates: Will they Fall or Rise? – Experts’ Verdict

As the global economy continues to navigate through the paradigm shifts, all eyes remain steadfast on the gold market. The question looming over everyone’s mind: Will the gold rate fall or rise further? Historic patterns in gold rate fluctuations and expert analysis offers an interesting perspective. Economists and financial pundits emphasize several factors such as…

-

Forbes Top 10 Cryptocurrencies Of April 15, 2025 – Bitcoin Tops The Chart with Ethereum Behind

As the world continues to ride on the wave of digital currency adaptation, we present to you the top 10 cryptocurrencies of April 15, 2025. Bitcoin (BTC): As the pioneering cryptocurrency, Bitcoin continues to hold pole position in market cap, despite the emergence of numerous altcoins. Ethereum (ETH): It goes beyond being merely a digital…

-

Top 8 Performing Cryptocurrencies in 2025 – In-depth Analysis

As the crypto market steers into the second quarter of 2025, certain cryptocurrencies have taken the forefront, emerging as the year’s top performers. In this article, we delve into the unique attributes that have helped these digital assets soar:nn1. Bitcoin (BTC): Retaining its crown as the king of cryptocurrencies, Bitcoin continues to dominate the market…

-

Unprecedented growth of Crypto Market Cap from 2010 to 2025

From an obscure entity in 2010 to a prominent financial venture in 2025, the crypto market cap has witnessed an unprecedented surge. In 2010, the inception of Bitcoin, the first and most crucial cryptocurrency, paved the way for a new digital economy. At this point, its market cap was almost negligible. Fast forward to 2025,…

-

Silver’s Price Dip Amidst Easing Trade Concerns – A Temporary Setback or a Continuing Decline?

Silver, also known as the poor man’s gold, witnessed a significant drop in its value as the XAG/USD pair moved below the $32.50 benchmark. This unexpected turn of events is primarily credited to the easing of trade concerns across global markets. It appears that the worries regarding trade restrictions and tariffs are lessening, which triggered…

-

Silver Institute 2025 Survey Predicts Rise in Silver Prices due to Persistent Supply Deficit

The Silver Institute, in its 2025 Survey, foresees a persistent supply deficit propelling the price of silver significantly higher. According to industry experts, the deficit is a result of numerous factors ranging from decreasing mine production to growing industrial demand. Resultantly, silver, often dubbed as the ‘poor man’s gold’, is all set to triumph in…

-

Bullish Bias Remains for Gold & Silver Despite Powell’s Hawkish Tone

The precious metals market continues to display resilience despite the Federal Reserve Chairman, Jerome Powell’s, hawkish stance. While some investors may have anticipated a falter following Powellâs hawkish tone, Gold (XAUUSD) and Silver showed signs of substantial bullish bias. Indeed, the hawkish sentiments broadcasted by Powell failed to weigh down the metals’ rally. This may…

-

Gold Price Forecast: Surprising rates amid trade tension – Economic Times

Amid rising global trade tensions, the prediction of gold prices has taken a staggering turn. Noted financial experts forecast a soaring price of gold in the imminent future, sending ripples in the market landscape globally. The intersection of financial geopolitics with the global demand for gold is proving to be a catalyst for the metal’s…