Author: talupaWriter

-

Gold Price Predicted to Moderate in 2025, Harder To Achieve Massive Gains – Analysis

As we look ahead to the year 2025, experts are predicting a moderation in the price of gold, potentially leading to a period where massive gains are more difficult to achieve. This is in stark contrast to the previously continuous upwards trajectory of the precious metal’s value. Despite these predictions, gold remains a trusted safe…

-

Could Gold Prices Experience a 30% Decrease?

As a leading precious metal, Gold’s price fluctuation greatly impacts the global economy. Over recent years, the prices have been soaring high, but a big question now lingers: Can Gold Prices Drop 30%? Economic experts point out a few factors that could potentially cause such a significant drop. These include an upswing in real interest…

-

Here’s why 2025 is shaping up to be the year of altcoins

2025: The Year of Altcoins In the world of cryptocurrencies, change is the only constant, and the year 2025 is already promising unparalleled growth for altcoins. As we see key market shifts and the continuous evolution of blockchain technology, altcoins appear set to take center stage. While Bitcoin has always been the dominating force, a…

-

12 Top Cryptocurrencies Dominating The Market – Bankrate

In the evolving financial world, digital currencies – also known as cryptocurrencies – are making waves. Here are the 12 most popular types of cryptocurrencies:n1. Bitcoin (BTC): The first cryptocurrency, Bitcoin remains the most recognized and highly valued. n2. Ethereum (ETH): Known for its smart contract functionality. n3. Ripple (XRP): Distinguished for its real-time global…

-

The Driving Factors Behind the Recent Crypto Selloff: A Deeper Insights

On Monday, the world woke up to yet another alarming news – a significant dip in prices of major cryptocurrencies including Bitcoin and XRP. This tumble has not only sent shockwaves across the global crypto community but also raised important questions about the factors behind such a selloff.nnTo some market spectators, this downward trend reflects…

-

Gold Stands Strong Despite Economic Pressures, Silver at Risk – Heraeus and Kitco News

In the world of precious metals, gold’s resilience continues to stand out. Even with high bond yields and a shallower Federal Reserve rate path, gold remains unshaken. This resilience is a testament to the metal’s inherent value and stability, notwithstanding external pressures. However, silver prices appear more susceptible to economic fluctuations. With a potential US…

-

Commodities: Silver Price Fall – Unanticipated Early Monday Plunge Shocks Market

At the break of dawn on Monday, precious metals faced a jolt as Silver prices took a steep dive. Experts had seen a steady increase over the past month, creating a sense of security among investors. However, it’s not always calm seas in the realm of investments, especially in metals trading. This unexpected turn of…

-

Decline in Silver Price as XAG/USD Falls Below $30.50 Amid Slower US Fed Rate Cut Buzz and Stronger US Dollar

The precious commodity of silver has seen a decline in value, with XAG/USD dropping below the $30.50 mark. This has largely occurred due to the slower buzz surrounding US Federal rate cuts and a stronger US Dollar. Despite hopes for a rate cut that could have stimulated silver’s value, the pace of these potential cuts…

-

Analyzing the Potential for a 30% Drop in Gold Prices

Gold, traditionally viewed as a ‘safe haven’ investment, has witnessed its prices increase dramatically over the past decades. Yet the question arises, Can Gold Prices Drop 30%? The answer lies in the complex dynamics of the global economy, market sentiment, and investment strategies. While it’s not unprecedented for steep falls in gold prices, a 30%…

-

Gold Price to Moderate in 2025 according to CNBC report

In the world of precious metals, the golden era might witness a minor setback in 2025. For years, gold has been a reliable investment, heralded for its stability and massive gains. However, according to expert projections, as reported by CNBC, the pace of these impressive gains is expected to moderate in 2025. Gold has always…

-

Gold Value Drops 1% Following Boost in US Jobs Data and Strong Dollar

In the face of robust US jobs data that has served to strengthen the dollar, the value of gold has experienced a drop of 1%. It’s a notable shift in the market dynamics, reflecting the inherent strength of both the US economy and the value of its fiat currency. The correlation between the strong jobs…

-

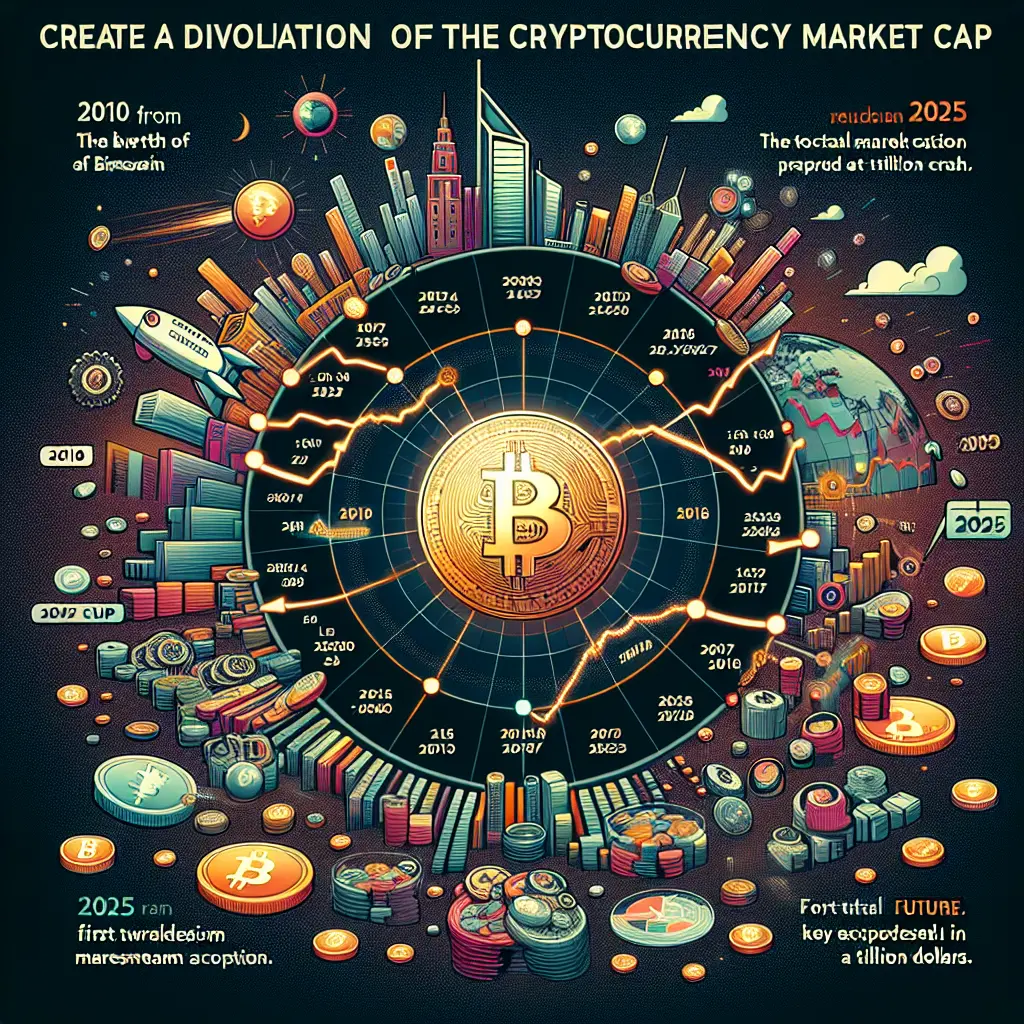

The Growth of Cryptocurrency Market Cap from 2010 to 2025: A Look at the Statistics

The journey of cryptocurrency market capitalization from 2010 to 2025 shows a remarkable trend of growth and resilience. Cryptocurrencies, initially considered a curiosity of the internet, spearheaded by Bitcoin, have now become a significant financial force. nnIn 2010, Bitcoin, the first and domineering cryptocurrency, held a trivial market cap. The following years, however, saw a…

-

Bitcoin Struggles At $93K Value Amid ETF Outflows: A Detailed Analysis

In a recent turn of events, the world’s dominant cryptocurrency – Bitcoin, has experienced a significant decrease, retreating to a valuation of $93,000. This substantial financial shift has occurred in direct response to an influx of Exchange-Traded Fund (ETF) outflows. nnDespite Bitcoin’s recent high-profile adoption by several corporations and financial institutions, this decline illustrates the…

-

Guide to the 12 Most Popular Cryptocurrencies: What You Need to Know

As the blockchain technology continues to evolve, cryptocurrencies are becoming more prevalent in our digital world. Here is a brief overview of the 12 most popular types of Cryptocurrency to shed some light on this intriguing digital economy: Bitcoin (BTC) The first and most infamous cryptocurrency, Bitcoin, was created in 2009. It still leads the…

-

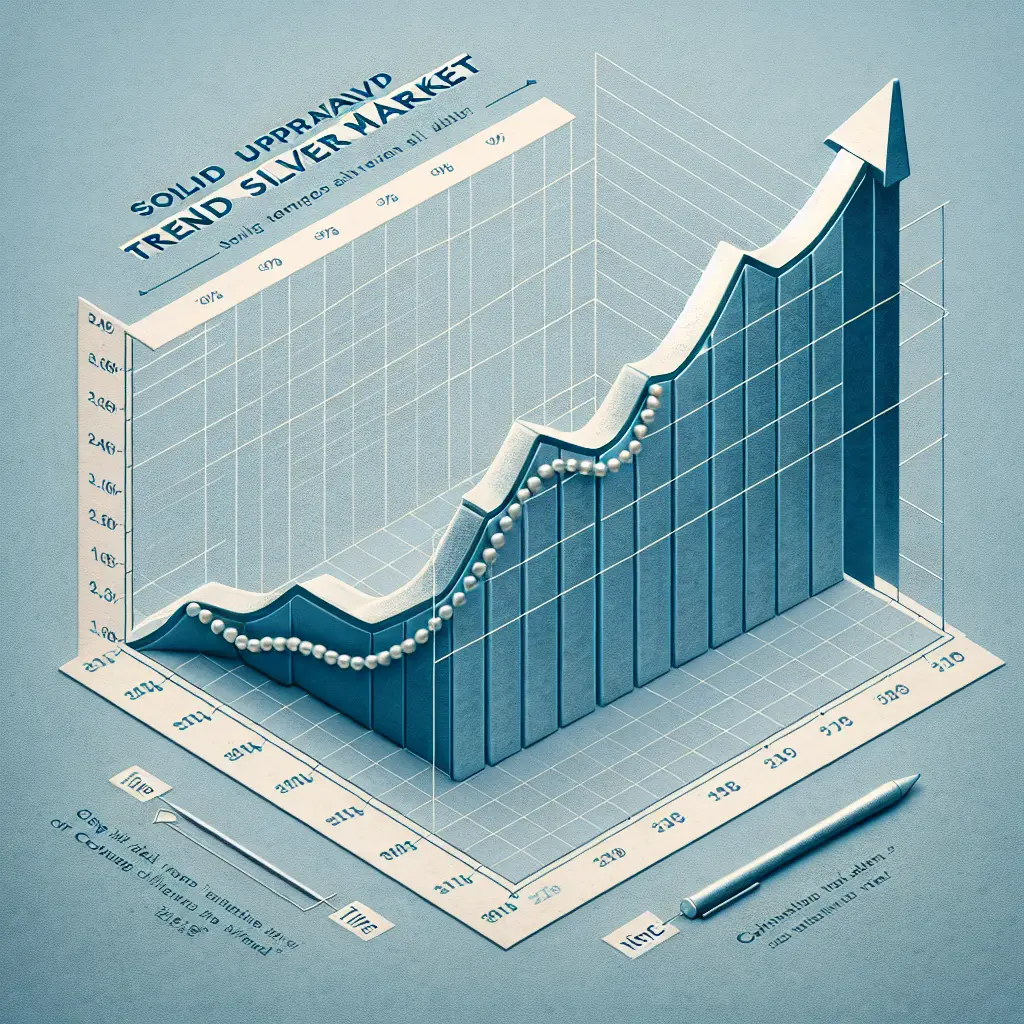

Silver Price Continues Upward Trend, Offering Potential Investment Opportunities

Amid fluctuating market trends, the silver market continues to demonstrate a remarkable endurance. This precious metal continues to grind to the upside, reflecting strong investor confidence alongside silver’s intrinsic value as a safe haven asset. This resilience amidst various economic uncertainties is a testament to silver’s standing in the marketplace. As per FX Empire, experts…

-

Retail Traders Bet on Gold for 2025, Experts Eye Silver’s Rise to the Top

Despite the fact that gold has a long-standing reputation as the most coveted metal in the commodities market, a recent survey hinting at potential disruption in the status quo reveals some riveting insights. Surpassing the halfway mark, more than 50% of retail traders are anticipating a repeat performance from gold, emerging yet again as the…

-

Silver Price Breaks $30 Barrier Amid Economic Volatility – FXStreet

In an unanticipated rebound, the price of silver (XAG/USD) accelerates beyond $30.00, fueled by elevated U.S. yields and a vigorous U.S. dollar. This surge comes as a response to jittery market sentiment and escalating inflation fears precipitating a rush towards precious metals as an alternative investment. Despite the U.S. dollar’s strength exerting pressure on commodities…

-

3 Possible Gold Price Scenarios for 2025: Steady Rise, Fluctuating Prices, and Bearish Outlook

As we approach 2025, the future of gold prices remains an intriguing topic of discussion. According to market experts, three potential scenarios could unfold: Steady Rise: In the most optimistic scenario, the value of gold could continue to rise steadily, thanks to increasing demand from investors seeking stability amid global uncertainty. Fluctuating Prices: Conversely, some…

-

Gold Prices Dip After Robust Nonfarm Payroll Report

In the aftermath of a robust Nonfarm Payroll report, gold prices showed a significant decline. The U.S. Bureau of Labor Statistics’ Nonfarm Payroll report is a critical economic indicator, reflecting the evaluated change in the number of employed people during the previous month, excluding the farming industry. A stronger-than-expected report, as we saw it, translates…

-

Gold Surges despite Strong U.S. Employment Data Amidst Trump Policy Uncertainty

Gold prices saw a significant rebound, defying the strong US employment data, owing primarily to the uncertainties surrounding the economic policies under the Trump administration.nnInitiating the week on a resilient note, the gold market latched onto a seeming paradox. Although US job data was notably robust, demonstrating a healthy economy, this did not discourage investors…

-

In-depth Analysis: Cryptocurrency Market Capitalization from 2010 to 2025

The cryptocurrency market has experienced significant growth and change from 2010 to 2025. Its journey began as a niche interest and quickly moved to a full-fledged juggernaut of an asset class. In the inaugural 2010, the cryptocurrency market had a modest market cap, dominated by Bitcoin, the pioneer of this digital asset revolution. The market…

-

Bitcoin Retreats To $93K Amid ETF Outflows – Investor’s Business Daily

In a surprising turn of events, the world’s most popular cryptocurrency, Bitcoin, has experienced a dip in its prices, falling down to $93,000. The drop is linked to the outflow experienced by Exchange-Traded Funds (ETFs) that majorly invest in cryptocurrencies. ETFs have been recently pulling their investments from Bitcoin, causing a ripple effect in its…

-

Exploring the 12 Most Popular Cryptocurrencies in 2025

12 Most Popular Types Of CryptocurrencynAs we venture into 2025, cryptocurrencies continue to grab the spotlight with their lucrative potential and volatile price shifts. Here, we delve into the twelve most popular types of cryptocurrencies captivating the market today.n1. Bitcoin (BTC) – The original and most prominent cryptocurrency.n2. Ethereum (ETH) – Notable for its smart…

-

Silver Continues to Withstand Pressures Above – Analyzing the Market Impact

The silver market has consistently experienced pressures from above, marking a distinctly turbulent period. Despite the headwinds, the precious metal continues to reflect a resilient spirit, hinting at underlying strengths that could potentially signal lucrative future prospects. Bullions, mining stocks, and exchange-traded products have all exhibited consequences of this pressure, but likewise also reveal silverâs…

-

XAG/USD Surges Above $30 Mark Bolstered by High US Yields and Robust USD

Continuing to make waves in the financial sector, the XAG/USD pair has seen a remarkable surge, exceeding the $30.00 mark. This incredible performance is strengthened further by the high yields in the US and a robust US Dollar. The precious metal’s value shows no sign of wavering in the face of economic uncertainty, demonstrating that…

-

Silver Price Forecast: XAG/USD Rises Ahead of US NFP Data

Silver Price Forecast: XAG/USD rises to near $31.30 Silver prices have seen a significant rise to near $31.30, gaining momentum ahead of the U.S. Non-Farm Payroll (NFP) data. The strong performance of the white metal suggests an optimistic outlook in the global market. Trending bullish, traders are flocking toward Silver, positioning it as a promising…

-

Gold Continues to Soar Despite Strong US Jobs Data: An Anticipation of the CPI Report

Despite the recent strong data indicating a robust labor market in the United States, the value of gold continues to rise unfazed, proving its resilience as a preferred safe-haven asset. This rally comes ahead of the release of the Consumer Price Index (CPI), a crucial economic indicator. Analysts anticipate that the upcoming CPI report could…

-

Gold On Track for Highest Weekly Close in Seven Weeks

As forecasters monitor the commodities market in close detail, it has become apparent that gold prices are on the track for the highest weekly closing in a period of seven weeks. The global economic tension propagated by various geopolitical factors has motivated investors to turn to gold, the perennial safe-haven asset. Consequently, there has been…

-

Gold Price Rebounds Amidst Trump Policy Uncertainties, Despite Strong US Jobs Data

Breaking news, the price of gold rebounds amidst growing uncertainty over Trump’s policies. This surprising development occurs despite the release of robust US jobs data. Analysts had been speculating that strong employment figures would dampen the investment demand for gold. However, concerns over future policy decisions by the Trump administration appear to have triggered a…

-

Understanding today’s crypto market downturn – Cointelegraph

As an observer of the crypto market, it’s clear that today’s downturn has left many investors scratching their heads. Many factors can contribute to these downward trends, such as governmental regulations, market manipulation, mass sell-offs, or even a lack of positive news within the crypto community. Factors Affecting the Crypto Market Regulation: Governmental policies and…