Author: talupaWriter

-

Silver Price Forecast Soars Amid Weaker US Dollar – FXStreet GMN Report

Precious metals saw a significant surge in the market, with the silver price (XAG/USD) soaring above the $30.00 benchmark in a favorable trend largely spurred by a precipitous dip in the value of the US dollar. This recent turn of events has industry analysts eyeing silver as a promising investment with potential for future growth.…

-

Gold and Silver Prices Sway Amid Trump’s Trade Tariffs Adjustment

As unexpected volatility rocked the gold and silver bullion markets, investors scrambled to establish their bearings on Monday. The sudden rise and fall of precious metals prices is linked to a ‘tweak’ in trade tariffs implemented by the Trump administration. In an unforeseen shakeup, gold and silver prices took a hit with traders forced to…

-

Analysis: 3 Gold Price Scenarios That Could Manifest in 2025

3 Gold Price Scenarios That Could Occur in 2025 Gold, a precious metal that has been a store of value for centuries, could witness a shift in price trend in 2025. As we navigate the financial waves of a post-pandemic world, here are the three likely scenarios: Steady Appreciation: Some experts believe that gold prices…

-

Gold Price Forecast: Bullish Momentum Builds Predicting a Strong Economy Outlook

As global economies continue to grapple with unpredictable variables, one thing remains consistent – gold’s bullish momentum. Recently, the price of gold has surged, breaking free from previous resistance levels, and instilling a renewed sense of optimism among resource market investors. Analysts had forecasted this gain, pointing to various international tensions and economic uncertainty. Not…

-

US Economic Data Impacts Gold Prices, Leading to a Downward Trend

Global gold prices have noted a downward trend, dipping in response to the rising yields. A simultaneous anticipation of United States economic data has supplemented the market’s preparation. This dynamic is a natural consequence in the financial world, where gold prices commonly act inversely to rising yields. Several investors and market observers have their attention…

-

XRP’s Price Surge: The Next Catalyst Unveiled – Barron’s

The cryptocurrency market has witnessed yet another surge, one that is propelling the price of XRP to new heights. Yesterday, XRP experienced its highest price jump in recent weeks – a significant event for the third-largest cryptocurrency by market cap. This surge has sparked an array of speculation on the future of XRP, pointing towards…

-

Bitcoin Hits a New High Above $102,000, Leads Cryptocurrencies Rally

It’s been a bullish start to the week for cryptocurrencies, with the market cap of the entire sector ticking upwards. The star of the show, however, is undoubtedly Bitcoin. The leading digital currency kicked off Monday’s trading session with a bang, soaring above the $102,000 mark – a fresh all-time high. It’s indicative of the…

-

Silver Continues to See Volatility – A Comprehensive Forecast

Silver has maintained its volatile characters as the commodity market witnessed a constant flux in 2025. The precious metal observed a challenging cycle, with its price volatility providing both investment opportunities and impressive uncertainties. The continuous changes in global economics, the competitive scenario between global powers, and unpredicted global events take part in this uncertainty,…

-

Silver Market Drama: XAG/USD Bears Dominate as Prices Struggle Below 200-day SMA

In the latest twist to the silver market, XAG/USD bears are dominating the trading charts, keeping silver prices below the 200-day Simple Moving Average (SMA) of $30.00, as reported by FXStreet. This pricing trend is influenced by several global market factors, including the US Dollar’s strength, the stock market’s performance, and geopolitical tensions. As traders…

-

Bullish Reversal Breakout: Silver Gas Price Poised For Recovery

Emerging from a period of consolidation, Silver Gas seems to be eying a progressive recovery following a bullish reversal breakout. This surge registers on the radar of major market players and denotes a promising trajectory for the metal commodity market. The predictive outcome is largely attributable to positive macroeconomic indicators acting as catalysts to this…

-

Market Volatility Affects Gold and Silver Prices Amid Trump Tariff Modifications

Volatility Hits Gold and Silver Prices Recently, an unexpected turn took place in the markets due to a ‘tweak’ to President Trump’s trade tariffs. This adjustment has caused significant volatility in the prices of gold and silver, two commodities often seen as safe havens during times of economic uncertainty. As a result of this change,…

-

The Rise in Gold Prices: Potential Investment Choices – CBS News

With the recent surge in gold prices, investors are undoubtedly eyeing this lustrous metal once again. Regularly, gold serves as a safe haven during volatile financial periods. But in the current favorable market conditions, gold assets are showing strength not just as a fallback, but as a potential wealth builder. For those interested in investing…

-

Gold Prices Take a Dive amidst Rising Yields & Pending U.S. Economic Data

In a surprising turn of events, gold prices have taken a dip as yields rise and financial markets brace themselves for forthcoming U.S. economic data. This trend has raised numerous eyebrows in the world of finance, creating a sense of anticipation among investors and traders across the globe. The shift in gold rates is directly…

-

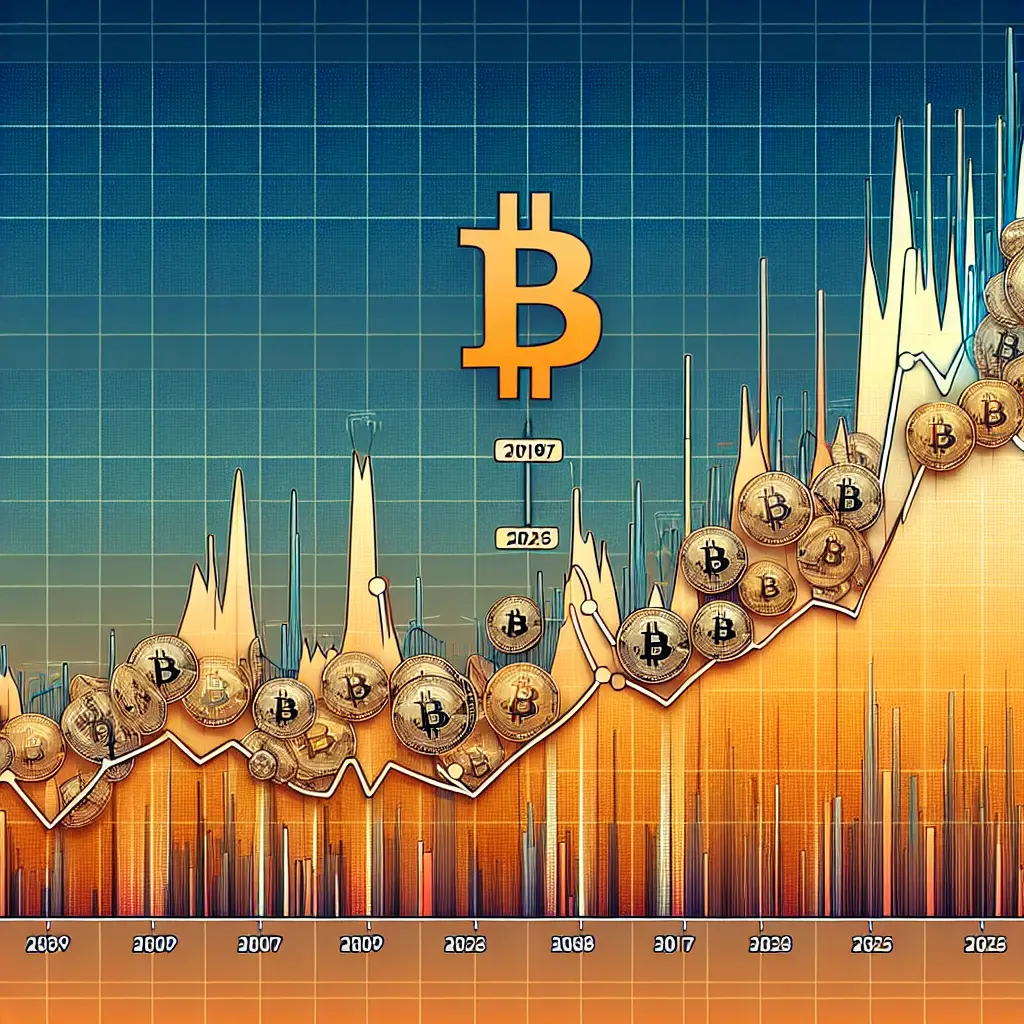

Bitcoin’s Price History: From 2009 Inception to 2025 Climax – Bankrate.com

Bitcoin, the brainchild of an anonymous programmer or group of programmers known as Satoshi Nakamoto, made its grand entrance in the financial stage in 2009. Digitally innovative, Bitcoin quickly gained traction, promising a combination of decentralization, security, and transparency. This revolutionary cryptocurrency has undergone extraordinary price trajectories over the years, reaching unprecedented peaks.nnFast forward to…

-

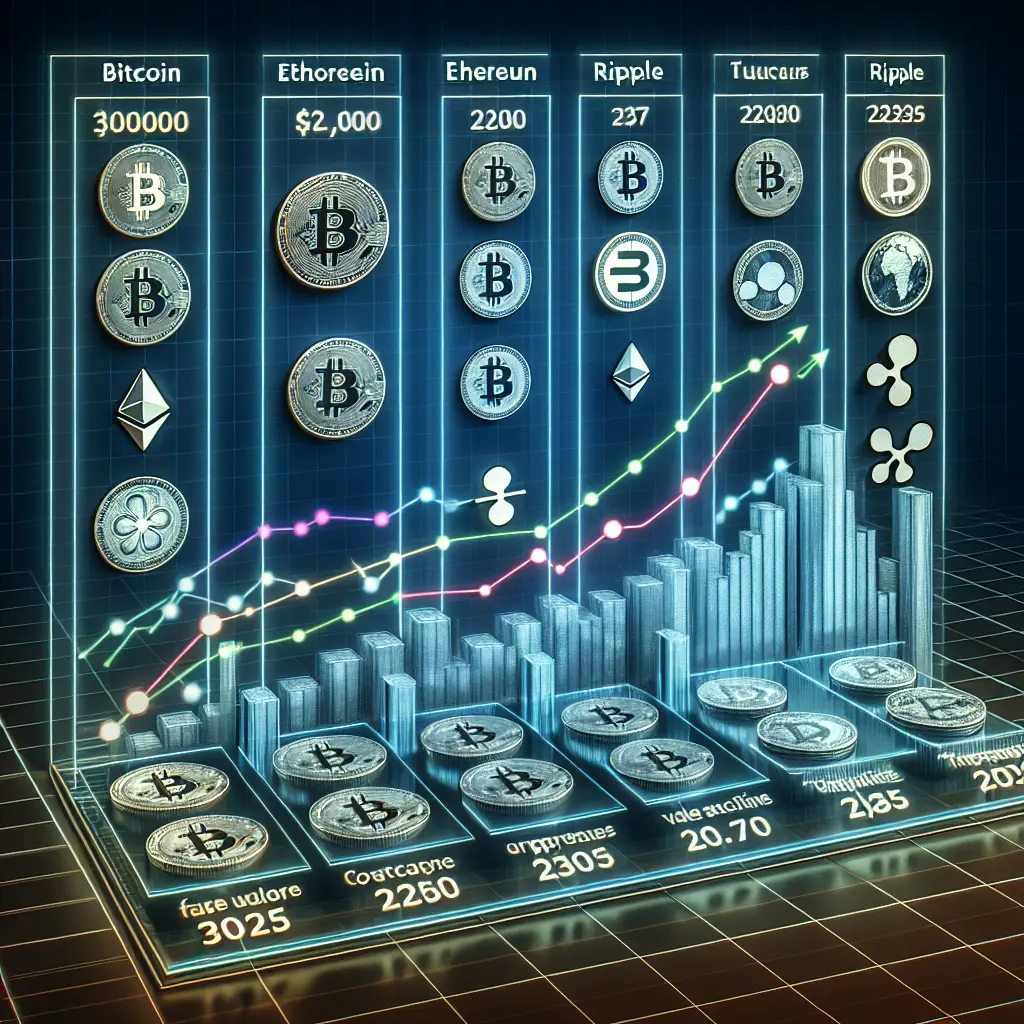

Future Predictions: Top 10 Cryptocurrencies of 2025 – Funds Society

With the exponential growth of cryptocurrency still in its infancy, predicting its future for 2025 seems like a major task. Over the past few years, we’ve seen some of the major crypto assets like Bitcoin, Ethereum, and others take on the mammoth-like proportions we see today. Bitcoin (BTC) By 2025, Bitcoin may cross the $100,000…

-

Bitcoin Surges to a New Record, Crosses the $107K Mark- Read More on Investor’s Business Daily

As the year comes to a close, Bitcoin, the titan of cryptocurrency, continues setting new precedents. In a bold stride, Bitcoin has reached a historic high, crossing the $107,000 threshold. This significant surge ruling the highest in its valuation indicates the ever-strengthening foothold of cryptocurrency in the global financial landscape. This record-setting peak has ushered…

-

Silver Forecast: Potential Impact of Easing Labor Data on Prices – FX Empire

As the world continues to monitor the fluctuations in global markets, one key factor to watch is the silver price forecast. Recent easing labor data has left investors wondering if a lift in silver prices might be on the horizon. Historically, labor data has been a significant indicator of a country’s economic health. When it…

-

Unprecedented Surge in Silver Prices: XAG/USD Near $29.50 Amid Increased Safe-Haven Demand

In a remarkable turn of events, silver prices have surged dramatically to approach the $29.50 mark. This trend appears to be driven by an increased demand for the precious metal as a safe-haven investment. With uncertainty clouding the global economy and investors seeking reliable assets, silver emerges at the forefront, strengthening its position as a…

-

Gold Sees Slip as Strong Dollar Holds its Ground

Gold, the ceaselessly glowing standard of investment, took a slip from its three-week high in the face of a strengthened U.S dollar. The dollar’s ascension has been registering palpable effects on various sectors, gold being one of the most insistent. The dollar’s substantial rise was a direct accomplice in gold’s stroll down the price step.…

-

Gold prices faced with struggles as ISM Manufacturing PMI reveals signs of recovery

Gold, which is often considered a safe-haven asset in times of economic uncertainty, is facing a challenging time. The ISM Manufacturing PMI, a key economic indicator, has risen to 49.3, closer to the 50-mark that separates growth from contraction in the sector. This implies that the U.S. manufacturing industry is slowly recovering, which typically decreases…

-

Gold Price Forecast: A Temporary Dip or a New Trend – XAU/USD Rates Confound Investors

Gold, one of the world’s most precious and sought-after metals, saw a downward trend as XAU/USD rates slightly eased on Friday. Investors seemingly turned their attention elsewhere, potentially exploring more lucrative investments. Despite the mild setback, industry experts maintain a positive forecast for the gold market. While the short-term outlook may seem bleak for some,…

-

The Top 10 Cryptocurrency Predictions for 2025 – A Comprehensive Look by Funds Society

As we step into the year 2025, let’s take a detailed look at the top 10 cryptocurrency predictions by Funds Society. Bitcoin (BTC): Expected to continue as the undisputed leader in 2025, Bitcoin’s value is predicted to soar further due to reduced supply. Ethereum (ETH): With its ongoing developments, Ethereum could bridge the gap with…

-

Bitcoin Soars to New Heights Hitting Record $107K

Undoubtedly, Cryptocurrencies have demonstrated their financial prowess as an innovative asset class. Of these, Bitcoin has been the leading light, often referred to as the ‘digital gold’ of our times. Today, we celebrate yet another milestone as Bitcoin reaches a new all-time high above $107,000.nnThis record-breaking feat showcases the promising adoption, acceptance, and investment into…

-

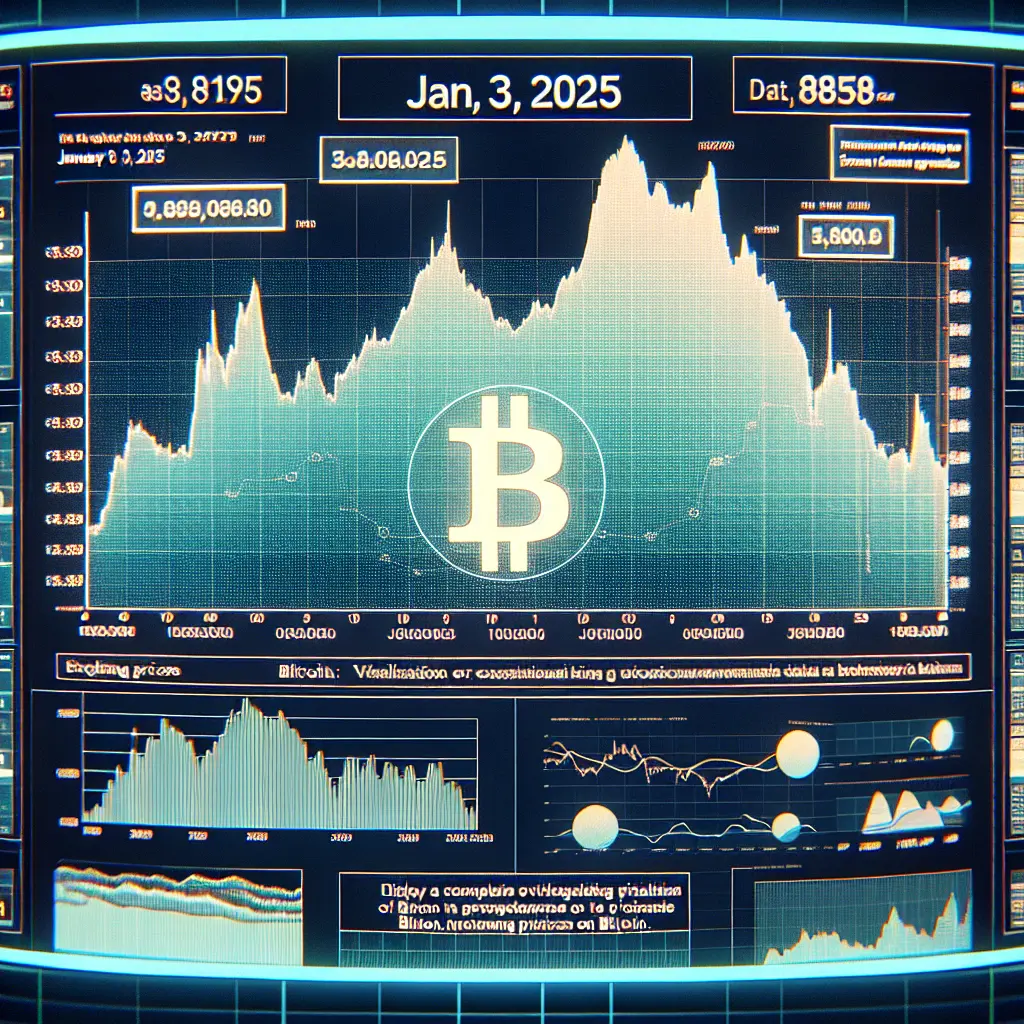

In-Depth Analysis: Bitcoin Price Activities on January 3, 2025

The Bitcoin market on January 3, 2025, witnessed some interesting activities. On this date, the price of the well-renowned cryptocurrency, Bitcoin, saw some significant rises and falls. This unstable trajectory that Bitcoin followed in the market is not uncommon. Bitcoin, considered the digital gold of this era, has often experienced extreme highs and lows. Despite…

-

The Gold Bull Market Surges Without U.S. Involvement – An Unforeseen Economic Phenomenon

In an unexpected turn of events, the gold bull market has surged upward with surprising strength, in spite of the U.S. not being an active participant. Gold, traditionally seen as a safe haven in times of economic and geopolitical uncertainty, continues to climb new heights. The burgeoning gold bull run can be attributed to a…

-

Analysing Silver Price Outlook; Silver Facing Resistance

With the ongoing uncertainties in the global economic landscape, all eyes remain on the silver markets. The precious metal, famously known as ‘poor man’s gold’, continues to display a robust resilience, seemingly unfazed by the evolving macroeconomic environment. Despite facing several near-term pressures, silver has managed to maintain its lustre, consistently looking at major resistance…

-

Silver Price Soars Amid Safe-Haven Demand – FXStreet

The precious metal, Silver, is making headlines as XAG/USD surged to hover near the $29.50 mark due to a significant increase in safe-haven demand. The global economic uncertainties have bolstered the metalâs status as a reliable store of value, attracting investors to pile onto their silver reserves. This has ignited a spark in the silver…

-

Gold Price’s Struggle with Rising ISM Manufacturing PMI – A Market Update

The ongoing struggle of gold prices becomes more prominent as the ISM Manufacturing PMI edges upwards to 49.3. Traditionally, gold shares an inverse relationship with strong economic indicators such as the PMI. A higher PMI often suggests manufacturing strength, which improves investor confidence in the economy and reduces apprehension – often leading to diminished demand…

-

Rising Gold Prices – Identifying the Best Gold Assets to Invest in Now

With the rise of gold prices in the market once again, investors are beginning to look more closely at gold assets. This surge, often tagged to economic fluctuations or political turmoil, has made gold a sanctuary for those seeking stability in an otherwise unsteady market.nnThree types of gold assets are worth considering – gold bullion,…

-

Update on Gold’s Performance: A Bit of a Dip as XAU/USD Eases and Investors Diversify – FXStreet

The XAU/USD exchange rate came under some selling pressure on Friday as investors began to look elsewhere for investment opportunities. Even though Gold is often considered a safe haven, it appears that the allure of other markets was too great on this occasion. That said, this does not necessarily signal a bearish trend for XAU/USD.…