Author: talupaWriter

-

Wall Street Forecasts Gold to Shine Once More in 2025

As the world continues to grapple with economic uncertainties in the backdrop of ongoing geopolitical tensions, Wall Street anticipates a shiny future for the lustrous yellow metal – Gold. Experts predict the gilded asset could serve as a steadfast investment beacon, lighting up the way for keen investors in 2025.nnGold, an age-old symbol of wealth…

-

Cryptocurrency Markets in 2025: Insights and Predictions

As we approach 2025, the cryptocurrency market continues to evolve at a rapid pace. Bitcoin, the pioneer of cryptocurrencies, remains at the forefront, while other digital currencies such as Ethereum and Ripple follow hot on its heels. Analysts predict that these markets will only continue to mature, ushering in regulatory standards, technological advancements, and more…

-

Bitcoin Struggles to Hold the $100,000 Mark Amidst Market Uncertainties

Following a recent surge, the Bitcoin rally appears to be losing momentum, with the premier cryptocurrency battling to reclaim the $100,000 price point. Bitcoin, renowned for its volatile nature, has been grappling a myriad of challenges including regulatory scrutinies and investor skepticism. Since reaching the milestone of $100,000, Bitcoin experienced a sharp correction that saw…

-

Bitcoin Soars to New Heights: Breaks Record with Over $107K Value

In a recent turn of events that has taken the financial markets by storm, Bitcoin, the world’s largest and most popular cryptocurrency, has hit an unprecedented high of over $107,000. This record-breaking event comes at a time when investors across the globe show increased interest in digital assets. Bitcoin, famous for its volatile swings, continues…

-

Pressure Mounts on Gold, Silver Prices Amid Rising U.S. Bond Yields

Pressure on Gold and Silver Prices Amid Rising U.S. Bond Yields Recent macroeconomic factors have been exerting pressure on the prices of gold and silver. The revival in the U.S. Treasury yields has simmered down the shine of these precious metals. As per the latest statistics, the U.S. 10-year Treasury yield has seen a significant…

-

Silver Price Weekly Outlook: Selling Pressure Persists – FX Empire

The silver market is enduring hefty selling pressure, observable in this week’s performance. Traders and market pundits alike are keeping a wary eye on the delicate equilibrium of demand and supply factors. This, coupled with macroeconomic uncertainties which are increasingly impacting the strength of leading global currencies. On one hand, silver demand, particularly for industrial…

-

Silver Price Today: Decreases on December 27th – Industry Watch by FXStreet

Silver Price Today: Dips on December 27th In the ever-fluctuating world of precious metals, silver made a noticeable dip on December 27th, according to data analyzed by FXStreet. While many market participants had their eyes on gold, experts were keeping track of the often-underestimated silver. This downward trend shows the unpredictable nature of the market…

-

Gold Price Pressured by Rising U.S Bond Yields Amidst Holiday Trading Week

Gold price under pressure from high US bond yields in holiday trading week – MINING.com With the holiday trading week in full swing, gold prices are under significant pressure due to a surge in U.S. bond yields. As investors flock to perceived safe-haven assets amidst economic uncertainty, the higher yield on U.S treasury bonds dampens…

-

Gold Price Wavers Around 20-Day Moving Average: A Challenging Resistance to Overcome

In the world of precious metals trading, gold prices have been demonstrating a significant resistance around the 20-day moving average. In a battle of wills, the gold market is trying to gain an upper hand but is consistently met with obstinate resistance level. This narrative is bringing both tension and excitement to the gold trading…

-

Steady Gold Prices Despite Quieter Holiday Trade – Analysis

The holiday trading period has seen a particularly firm settling of gold prices, even during times of less trading activity. This underscores gold’s enduring value as a safe haven investment, particularly in times of global economic uncertainty. Investors have shown faith in the precious metal, leading to a sustainable growth in value, irrespective of the…

-

Money Matters: Cryptocurrency VS the US Dollar – An insightful look into the evolving world of finance

Money Matters: Crypto currency vs. the US dollar – Gold Country Media In today’s digital age, the arena of financial transactions is never constant. Traditional forms of currency, like the US dollar, now share the stage with more modern financial mechanisms: Cryptocurrencies. Cryptocurrencies like Bitcoin, Ethereum, and Lite coin have been erupting on the financial…

-

5 Surprising Top Cryptocurrency Trends to Watch in 2025

By 2025 innovative trends in the cryptocurrency world will have transformed the economic landscape. Here are five top trends to watch: 1. Increased Institutional Investment Institutional investments in cryptocurrencies are predicted to rise dramatically. Multinational corporations and financial institutions are taking a step forward to embrace the power of cryptocurrency. 2. Regulatory Clarity As the…

-

Breakdown of the 12 Most Popular Cryptocurrencies – An analysis brought to you by Bankrate.com

Cryptocurrency continues to revolutionize the financial world, with a diverse array of coins making waves in the market. Below are the 12 most popular types of cryptocurrencies: Bitcoin (BTC) Bitcoin remains the most renowned cryptocurrency, pioneering the concept of digital assets. It operates on blockchain technology, furnishing a decentralized alternative to traditional banking. Ethereum (ETH)…

-

Silver’s Unexpected Dip on December 26, 2024 – A Temporary Blip or a Long-term Trend?

Silver, the sleek precious metal, took a roller-coaster ride on December 26, 2024, as per data reported by FXStreet. After showing consistent strength in its performance, the white metal unexpectedly took a dip, causing ripples in the commodities market. Though this event bewilders some, most market analysts see this as part of silver’s volatile nature…

-

Analysis: Silver Continues to Struggle With $30 Mark – Market Trends & Future Predictions

Despite potential market indicators favoring an upward trend, Silver continues to dance around the $30 price mark. The precious metal, usually a solid investment, should be enjoying a price boost in response to market uncertainty but has been surprisingly stagnant recently. While short sales and futures contracts might be aiding the suppression of silver’s price…

-

Silver Market Update: Price Hovers Around Resistance – 24-12-2024

In today’s silver market, we can observe a standstill as prices hover around a significant resistance level. Traders and investors are cautiously watching movements in the silver market, waiting for signs of a breakthrough or bounce. This holds a substantial significance, particularly in the context of year-end trading where many platforms typically see high levels…

-

Gold Price Surge: Turning Jewellery into Cash – A Growing Trend

In a surprising turn of events, the recent surge in gold prices has given individuals an unexpected opportunity to earn extra cash. With the precious metal’s value reaching unprecedented levels, people are capitalizing on the phenomenon by selling their gold jewellery. The leap in gold prices has not only invigorated the economy but also empowered…

-

Gold Price Strengthen Significantly in Quieter Holiday Trading – Kitco NEWS

Amidst opening of the holiday season, the gold market witnesses a noteworthy activity. Contrary to the usual quiet trading in these periods, we have observed the price of gold strengthen substantially. The strength demonstrated by gold highlights the commodity’s status as a viable investment in times of uncertainty. While economic activities simmer down during the…

-

A Historical Overview of Gold Prices – How Do They Stack Up Today?

Despite fluctuations over the years, the price of gold has been on an overall upward trend, making it a safe haven for investors. In the 1970s, an ounce of gold was worth around $35. In the 1980s, this increased to $400, and by 2010, it had shot up to $1,200. Today’s gold prices in the…

-

Money Matters: Crytpocurrency vs USD – A Comparative Analysis | Gold Country Media

In the world of finance, the battle between cryptocurrencies and the US dollar is a hot topic for debate. The advent of cryptocurrencies, led by Bitcoin, has significantly affected the dynamics of the financial industry. These digital assets provide users with a new, decentralized way to conduct transactions. However, as cryptocurrencies continue to evolve, the…

-

Cryptocurrencies Future: 5 Key Trends for 2025

5 Surprising Top Cryptocurrency Trends To Watch In 2025 – Forbes As we approach the 2025 horizon, a new era of digital finance unfolds. From the maturation of blockchain technology to the rise of decentralized finance, get ready to be surprised by the top-five cryptocurrency trends. Decentralized Finance: The democratization of finance through blockchain technology…

-

Discover The Top 12 Cryptocurrencies Dominating The Market – Bankrate.com

In the last decade, the financial world has seen an exponential rise in the popularity of cryptocurrencies. The market is currently dominated by 12 leading cryptocurrencies, each offering diverse benefits and features for its users. Bitcoin (BTC): Undoubtedly the most popular and widely accepted cryptocurrency. Bitcoin brought about the dawn of the crypto era. Ethereum…

-

Significant drop in Silver Price Witnessed on December 20 – FXStreet

Silver prices took a tumble on this day, marking a significant drop in the silver market. Historically, fluctuations in the market have always been a natural part of the trading process, and today, the 20th of December, was no exception. Despite the various factors contributing to a healthier economy, silver found itself on the losing…

-

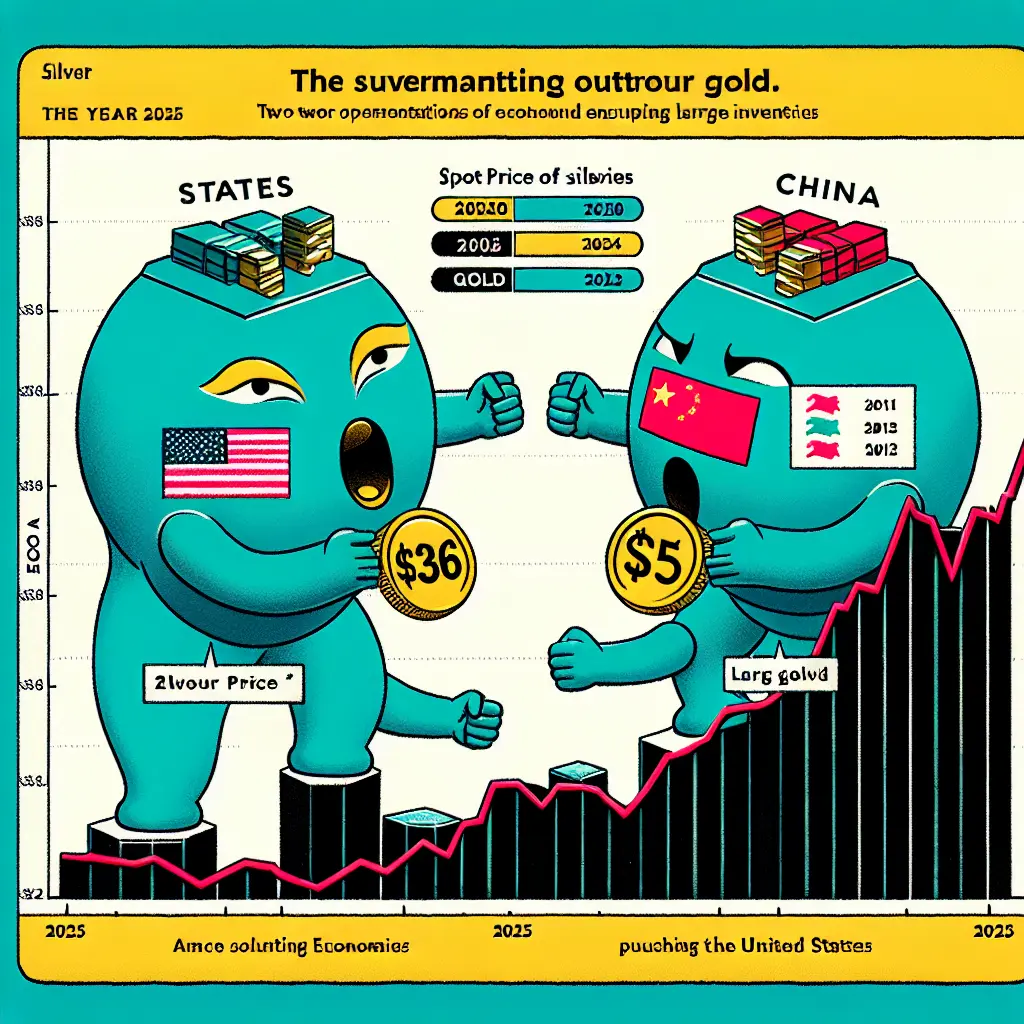

Silver to Surpass Gold in 2025 as Economic Rebounds in China, U.S. Increase Demand

Silver has been forecasted to outperform gold in 2025 with major economies including the U.S. and China expected to absorb inventories, thereby increasing the spot price to $36 per ounce, according to TD Securities. This prediction reflects the increasingly significant role of silver in the global marketplace. Economic rebounds in the U.S. and China are…

-

Silver price hovers around the resistance – Forecast Today – Economies.com

On this festive December morning of December 24, 2024, the world of commodities is glistening with a hue unseen before. The silver price steadily lingers around the resistance, forecasting a vital time in the global economy. As we navigate through these uncertain financial periods, the silver seems to symbolize resilience, avoiding any major fluctuations. The…

-

Gold Price Projections for 2025: Unlinking from the US Dollar and Federal Reserve’s Policy

Gold price will not be at the mercy of the US dollar or Fedâs monetary policy in 2025- State Streetâs George Milling-Stanley – Kitco NEWS In a bold forecast for the year 2025, George Milling-Stanley, the Chief Gold Strategist at State Street Global Advisors, shares his outlook on the relationship between gold price, the US…

-

Gold Price Forecast: Steadiness Observed Around $2,610 as Christmas Eve Approaches

Gold Price Forecast: XAU/USD holds around $2,610 ahead of Christmas Eve – FXStreet As we navigate towards the Christmas season, the price of gold (XAU/USD) steadies around the $2,610 mark. Investors, observers, and traders keenly watch and hold their breath, anticipating movement in the precious metal’s value as the year comes to a close. Bearing…

-

Analysis: Comparing Today’s Gold Prices with Historical Data

With an enduring appeal that has spanned Millennia, gold has been viewed as a store of value, a symbol of wealth, and a hedge against inflation. In this analysis, we look into how today’s gold prices stack up against historical figures. We examine the prices from major timelines, starting from the U.S. abandonment of the…

-

Altcoins Surge Amid Bitcoin’s Drop, Signalling Possible Altseason – Crypto Market Analysis

There has been a significant shift in the cryptocurrency market as the top 100 altcoins make substantial gains, leaving Bitcoin in their dust. This surge in altcoin prices has raised speculation of a possible ‘Altseason’, a period where alternative cryptocurrencies outperform Bitcoin. While Bitcoin remains the undisputed king of cryptocurrencies, its dominance has been steadily…

-

Three Significant Factors to Affect Bitcoin in 2025

As we look ahead to 2025, there are three significant factors to keep on the radar for Bitcoin enthusiasts and skeptics alike. The first is continued integration into the mainstream finance. More banking institutions appear keen on offering Bitcoin services to their customers, suggesting greater acceptance and understanding of the cryptocurrency. The second is regulatory…