Author: talupaWriter

-

5 compelling reasons to invest in 1-ounce gold bars as a solid investment opportunity

In the world of investments, gold has always stood the test of time as a reliable choice. As we approach the year 2025, the potential benefits of investing in 1-ounce gold bars are particularly striking. Here are five reasons why you should consider this investment avenue: Inflation Hedge: Gold has traditionally served as an inflation…

-

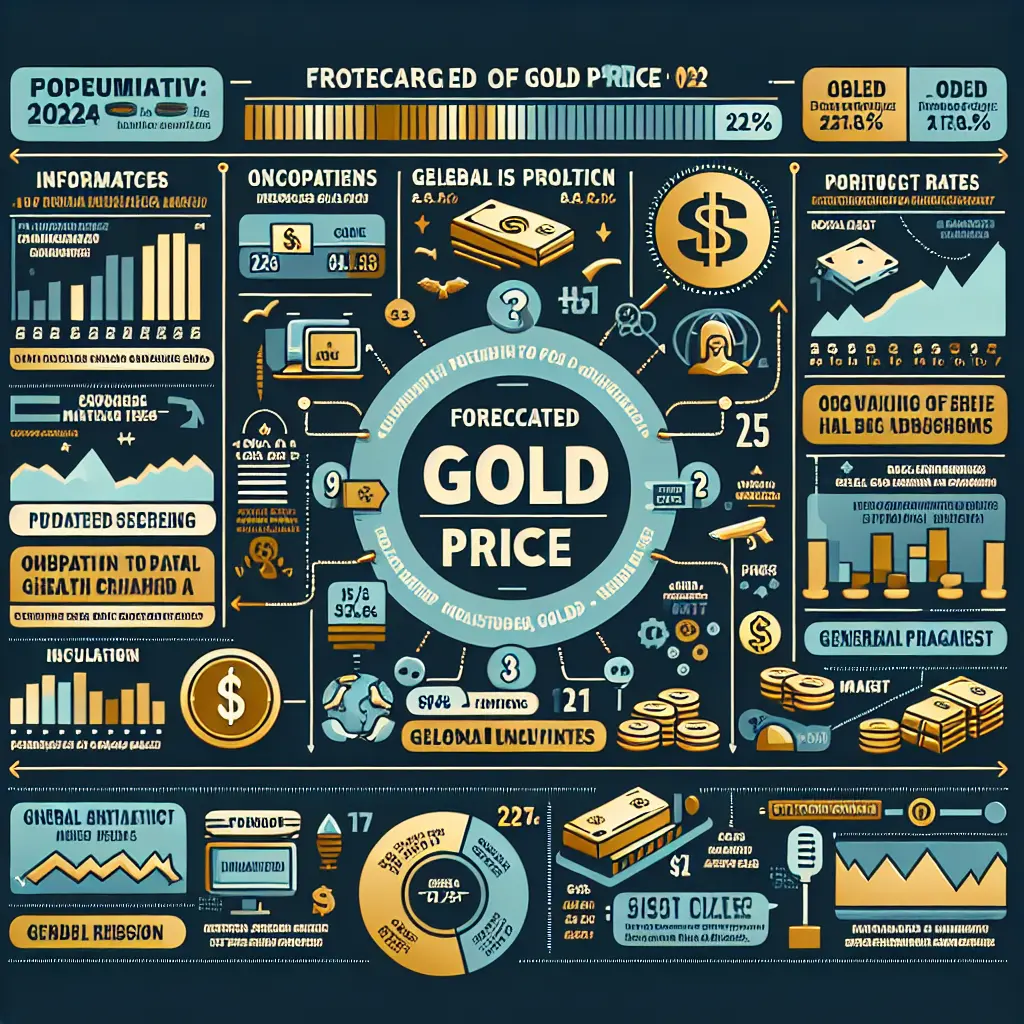

An In-depth Look at Gold Price Analysis

In this article, we will delve deep into the world of gold price analysis. The price of the precious metal is a nuanceed issue affected by a maelstrom of factors, from geopolitical tensions to the health of the global economy. We will break down these factors and their impact on the price of gold, providing…

-

Gold Prices: Wall Street and Main Street Anticipate Movements ahead of CPI, PPI Data Release

In what appears to be a noteworthy prediction, Wall Street is anticipating gold prices to remain stable, if not higher, in the coming week. This speculation stems from the expectation of forthcoming Consumer Price Index (CPI) and Producer Price Index (PPI) inflation data.nnMain Street, on the other hand, appears to be more bullish. This sentiment…

-

Trump Ready to Support Bitcoin and Other Cryptocurrencies

In an unprecedented move, former President Donald Trump has signaled his readiness to embrace Bitcoin and other cryptocurrencies. This financial leap has the potential to shake up markets and revolutionize the way transactions are conducted. For traders and investors, it’s time to buckle up for a roller-coaster ride. Trump Backs Cryptos Trump, known for his…

-

Bitcoin Leaps to Unprecedented Heights – $100,000 Milestone Reached

In an unprecedented financial turn of events, the price of the world’s premier cryptocurrency, Bitcoin, has sky-rocketed to a monumental $100,000. This historic milestone marks a new chapter in the story of financial investments and cyber currency. Bitcoin, once considered a risky proposition, has proven its skeptics wrong with this extraordinary feat, a testament to…

-

Bitcoin hit the $100k mark: Could it keep climbing?

On the 6th of December, Bitcoin, the pioneer of cryptocurrencies, achieved another milestone by crossing the $100,000 mark. A never before seen level, undoubtedly causing a stir amongst investors and enthusiasts alike. The digital coin, often referred to as ‘digital gold’, has displayed an incredible surge in 2024, baffling skeptics and experts who initially had…

-

Can Silver Surpass Gold in 2025? Find Out What the Experts Predict

As we approach 2025, the debate in the precious metals markets is heating up. Investors around the globe are questioning whether silver can outpace gold in the coming year. The rising industrial demand for silver, especially in solar panels and electronics, and an overall lustre for riskier assets, could enhance its potential. However, gold still…

-

Predicting Silver’s Market Performance in 2025: Could it Surpass Gold?

As we approach 2025, market analysts and precious metal experts are speculating on the role of silver in the coming year and how it might compare to its more expensive counterpart, gold. For years, gold has dominated the precious metals market, serving as a safe haven for investors during times of economic uncertainty. However, some…

-

Volatility Remains A Key Factor In Silver Prices – FX Empire

The global investment landscape is experiencing a rollercoaster ride, and at the heart of it, we see Silver. The shiny metal has been consistently volatile in its pricing, creating a mix of anxiousness and intrigue among investors worldwide. This volatility in Silver prices has been particularly pronounced in recent times, mirroring the economic instabilities and…

-

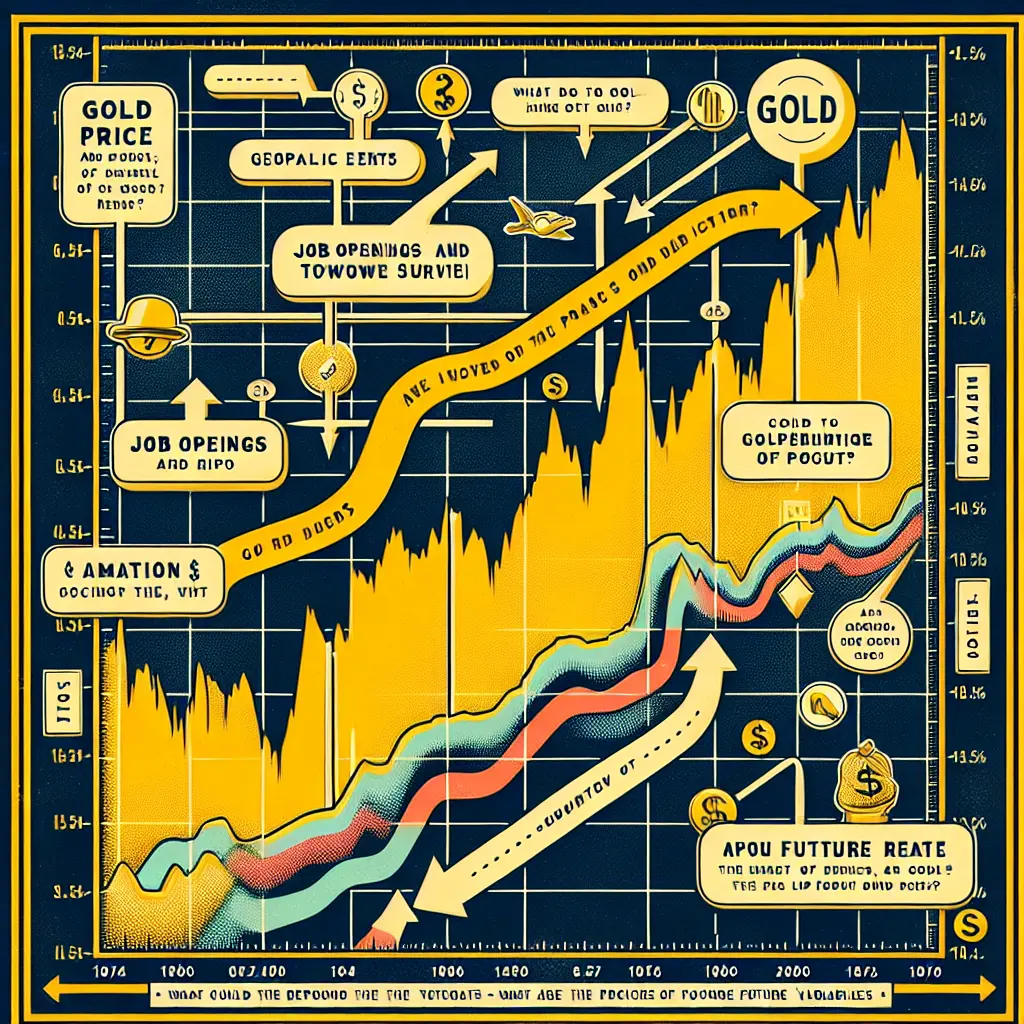

Gold Stays Strong Amid Dollar Weakness Preceding Crucial Jobs Report

As the world braces for a significant jobs report that holds potential sway over financial markets, gold prices experience a cushioning effect brought by the erosion of dollar value. This unpredictable relationship between gold and the dollar continues to draw the interest of investors globally. By standing tall against the weakening dollar, gold secures its…

-

Bear Flag Breakdown Introduces Uncertainty into Gold Prices – Insights from FX Empire

With the recent bear flag breakdown, the gold prices face a significant deal of uncertainty. This precarious situation comes hot on the heels of a period of relative stability in the trading of the precious metal. The decrease in demand, combined with unpredictable economic conditions across the globe, has stirred this uncertain situation. Will the…

-

Wall Street’s Outlook on Gold Prices Ahead of CPI & PPI Inflation Data

Wall Street experts are predicting a steady-to-higher trend for gold prices heading into next week. Similarly, Main Street investors are shown to be more bullish excessively. The anticipation is building up as critical CPI and PPI inflation data are imminent. These data are often a strong determinant of gold prices and, therefore, bring an air…

-

Understanding the Drop in Ripple’s Cryptocurrency, XRP, Today

There has been a perplexing development in the crypto market today. XRP, Rippleâs native cryptocurrency, has experienced a noticeable dip. This article breaks down some contributing factors.nnOver the past month, XRP had been on an upward trend, echoing the bullish vibes resonating throughout the crypto market. However, today the tide seems to have turned. The…

-

Bitcoin Hits Historic $100,000 Milestone – A Shakeup in Financial Industry

Bitcoin price hits $100,000 for the first time – NBC News Breaking news, collective shockwaves reverberated across the financial industry as Bitcoin, the world’s leading cryptocurrency, breached the $100,000 mark for the first time in history. The unprecedented milestone, recorded on Dec 5, 2024, has proven Bitcoin’s enduring value and its growing recognition as a…

-

Exploring the Potential of Silver Outpacing Gold in the year 2025 – An expert’s opinion

As we approach 2025, the precious metals market is abuzz with speculations and forecasts. One rampant question that market observers seem fixated on is – ‘Can silver outpace gold in 2025’?nnThe price of gold has traditionally dominated that of silver. However, several financial experts and market analysts believe that this could change in 2025. There…

-

Silver Price Forecast – Deteriorating Under Continued Pressures – FX Empire

The price forecast of silver remains gloomy as silver continues to experience pressures amidst global economic uncertainties. The silver market is wrestling with several detrimental factors that are towing down its value. This predominantly includes an elevated dollar, which inversely affects commodity prices, and unsettling economic data that stokes investor apprehension. Despite its status as…

-

JPMorgan’s Gold and Silver Price Forecast for 2025 and 2026

Leading global banking institution, JPMorgan, has released its anticipated gold and silver price outlook for 2025 and 2026. This informative and critical analysis could be a beacon for investors and stakeholders in the precious metals market in the coming years. nnThe bank’s confidence in both gold and silver prices reflects the ongoing trends in global…

-

Gold Price Forecast December 2024: Predictions and Trends – CBS News

As we approach the end of 2024, the financial world turns its eyes towards the shiny yellow metal, Gold. Given its status as a safe haven during uncertain times, it becomes increasingly relevant to predict its performance in the coming month of December. Several factors could impact the price of goldâthe ongoing pandemic situation, inflation…

-

Urgent: Temporary Instability in Gold Prices as Market Turmoil Mounts

In the midst of the current economic tumult, gold prices flash a cautionary signal to investors. Regarded worldwide as a stress gauge for global financial markets, the sudden oscillation in the gold prices suggests potential short-term instability. The sudden surge of gold prices has triggered concern among investors, pushing many to reassess their investments in…

-

Gold’s Response to JOLTS Report and Future prospects with More US Economic Data

Gold Pares Gains Gold has pared its gains after the release of the Job Openings and Labor Turnover Summary (JOLTS) report from the U.S. Bureau of Labor Statistics, investors are now eyeing additional U.S. economic data for further direction. The JOLTS report highlighted the condition of the U.S. labor market, with data that potentially may…

-

Crypto Liquidations Reach $588M Amid Major Price Swings in XRP, Bitcoin, Ethereum, Dogecoin

The world of cryptocurrency was shaken as liquidations hit a staggering $588 million. Major cryptocurrencies such as XRP, Bitcoin, Ethereum, and Dogecoin witnessed huge price swings. Their volatility is indicative of the uncertain environment in the crypto world. While many investors use these fluctuations to their advantage, others find the unpredictability a challenge. These liquidations…

-

Cryptocurrencies Price Prediction – American Wrap: Ethereum, Bitcoin on 04 Dec 2024 – FXStreet

In the fast-paced world of cryptocurrency trading, predicting the market’s trends can sometimes feel like a high stakes gamble. However, intelligent investors understand the utility of informed forecasts to guide their decisions.nnFor those trading in Ethereum, Bitcoin, and other cryptocurrencies, it is essential to keep an eye on market trends and predictions. This American Wrap…

-

Ripple’s Upcoming Venture into the Regulated US Crypto Market Pending New York’s Stablecoin Approval

The fintech company, Ripple, is on the brink of securing a huge milestone in its history. Ripple is positioned to receive approval from New York authorities for its stablecoin, marking Ripple’s maiden journey into the regulated US crypto market. This monumental step, if approved, signifies a further legitimation of cryptocurrency in the US financial system…

-

Pullback and Consolidation in Silver Prices: An Indication of What’s Next?

After a long period of bullish trend, the price of silver appears to be settling into a period of consolidation. Market enthusiasts and investors need not be alarmed – this pullback is a natural part of market movement, especially after a phase of intense growth. On analysis, technical charts suggest that silver is preparing to…

-

Silver Price Shows V-shape Recovery Post US ADP Job Data Release

The silver market showcased a dramatic V-shape recovery, bouncing back from $30.50, following the release of the US ADP job data. nThe American Dollar has been on a roller-coaster ride, which saw repercussions in silver prices that jumped significantly compensating its previous losses. nSilver prices denominated in USD (XAG/USD) displayed strength, a direct implication of…

-

JPMorgan’s Gold & Silver Price Predictions for 2025 & 2026 -Expert Analysis

Here is JPMorgan’s gold and silver price outlook for 2025 and 2026 Investment banking giant, JPMorgan Chase & Co., has released its gold and silver price outlook for the years 2025 and 2026. Citing robust market fundamentals and macroeconomic factors, the bank predicts positive trends for these precious metals in the upcoming years. Gold Price…

-

Unprecedented Quadrupling of Gold’s U.S. Market Share: Potential Impact on Gold Prices – Rick Rule Predicts

Gold’s U.S. market share is set for a stunning fourfold increase, according to industry expert Rick Rule. In an exclusive interview with Kitco NEWS, Rule sheds light on the potential implications of this shift for gold prices. Investors and market watchers alike are speculating on the potential consequences of this sizable market shift. Despite Gold’s…

-

Gold Pares Gains Following U.S. JOLTS Report, More Data Awaited

After the release of the JOLTS report, gold pared some of its earlier gains. However, investors are keeping a close eye on the upcoming U.S. data. The Job Openings and Labor Turnover Survey (JOLTS), a reputable source of labor statistics, plays a crucial role in predicting gold performance. The correlation stems from gold’s status as…

-

Exploring the Maturity of Crypto Markets

Crypto Markets Have Grown, But They Still Havenât Grown Up. Published on Forbes on November 30, 2024. Despite the leaps and bounds in technology and the enthusiastic investors pumping billions into cryptocurrencies, the crypto market is still marred by a streak of ‘childishness’. This isn’t about a lack of seriousness, but rather about the deficiency…