Category: Commodity Market

-

Gold Market Analysis: Current Price of Gold as of December 30, 2025

As we bid farewell to 2025, the precious metal market shows a glimpse of resilience and adaptability. It’s been a fascinating journey for gold this year, experiencing fluctuations and soaring heights. As of today, the price of gold stands firm… Read More

-

Record High Gold Prices – Impending Fed Minutes & Year-End Thin Liquidity

Gold Price Shines Bright Today With Unparalleled Highs Digging into the economic news, the liquidity of gold today stays thin near the end of the year, reaching pit to new highs. This surge comes as anticipation looms for the nearing Federal Reserve minutes. While investors navigate the volatile course of the market, gold seems to…

-

Silver’s Soar and Gold’s Glory: Predictions for 2026. BMO Capital Markets Outlook

In a remarkable turn of events, the silver industry has seen an inspiring upsurge. The predicted silver price for 2026 has seen a significant revision towards a higher valuation as reported by BMO Capital Markets and Kitco. However, the gold market is still expected to outshine silver’s market performance. Despite the positives around silver’s valuation,…

-

Gold, Silver Stability: Bullish Trend Underpins Investment Potential

In the world of commodity markets, the stability of gold and silver holds a special significance. As per recent trends observed on Yahoo Finance, both these precious metals have continued to maintain a steady price amidst market volatilities. An ‘underlying bullish trend’ has further solidified their stance, attracting investors around the globe. The market scenario…

-

Comex Gold Rates Soar to $4,000/oz Today: Possible Short-Term Pullback?

Gold Price Today: An Overview Comex gold rates have skyrocketed to $4,000/oz today, an unprecedented leap in the cost of the precious yellow metal. This recent gold rally has brought about myriad concerns as to whether the precious yellow metal is set for a short-term pullback. Financial markets across the globe have been closely watching…

-

Current price of silver on Oct 16, 2025 – Detailed Analysis by Fortune

Current Price of Silver – A Detailed Analysis as of October 16, 2025 n n As the demand for silver continues to increase across various industrial sectors, it’s critical to stay updated on the current market price of the precious metal. On Thursday, October 16, 2025, the price hovers around X USD per ounce (could…

-

Gold Price Prediction for October 10, 2025: Profitable ‘Sell on Rise’ Strategy

As gold prices continue their volatile journey, analysts suggest that the ‘sell on rise’ strategy may be the most profitable way forward. The global political and economic atmosphere has had a major impact on gold prices. The immediate support seems to be at around $1700 per ounce as per recent indicators. The long term picture…

-

Current Price of Silver – Snapshot as of Monday, October 6, 2025

Current price of silver as of Monday, October 6, 2025 – Fortune As of Monday, October 6, 2025, the current price of silver experienced a relative stability, maintaining its position in the global market. The fluctuation of silver prizes is typically aligned with the current economic situation, with investors often resorting to silver during periods…

-

Historic Milestone: Gold Surges to Reach $4,000 Per Ounce – An All-Time High

In an extraordinary milestone, the yellow metal, Gold, has reached the landmark value of $4,000 per ounce. This benchmark, noted on Tuesday, October 7, 2025, signifies the all-time peak since the trading of gold began. This raises speculations about its continued ascension and implications in the global economy. Volatility in the economic markets, along with…

-

Silver Price Update | September 23, 2025 – Market Trends and Updates from Fortune

As investors globally keep a stern eye on the gold market, silver has been making waves of its own. As of Tuesday, September 23, 2025, the price of silver stealthily climbs the price ladder. This rise may be attributed to several reasons, mainly heightened industrial demand and investor appetite for commodities as a hedge against…

-

Gold (XAUUSD) Price Forecast: Drops 2% as Dollar Strengthens and Trade Tensions Ease

Following progressive signs of ease in trade tensions combined with a strengthening dollar, gold price dropped significantly by 2%. The US Dollar index has risen, causing inverse implications for the commodity priced in dollars. As investorâs appetite for riskier assets increased because of the easing trade tensions, the traditional safe-haven, gold dipped. If trade tensions…

-

Silver Price Outlook – Continual Pressure at the Same Area | FXEmpire

Over the past several weeks, silver prices have been exerting continuous pressure on the same price area. Despite revelations in the global market, silver has maintained a consistent trajectory with no signs of letting up. Traders are advised to keep a keen eye on this precious metal’s stability and potential for future disruption. With its…

-

Silver Price Forecast: Persistent Buyer Confidence Despite Sluggish Market

In the realm of commodities, the attractiveness of silver has remained undiminished despite a generally sluggish Thursday morning. This resilience is owed in large part to an unwavering pool of buyers who continue to seize every dip as an opportunity to fortify their silver holdings. Not only does this suggest robust confidence in the speculative…

-

Silver Price Drops Amid China’s Economic Downturn

In a surprising twist, the XAG/USD pair – an indicator for global silver prices – dropped below the $32.50 mark. This drop can be largely attributed to disappointing economic data from China, suggesting a potential slowdown in demand from the world’s largest consumer of the metal.## The economic data released by China, which includes GDP,…

-

Silver Price Prediction: Experts Forecast ₹1.17 lakh/kg within a Year

In an exceptional forecast by industry experts, the price of silver, widely known as white metal, could escalate to a staggering â¹1.17 lakh per kilogram within a year. The white metal, which has traditionally stayed in the shadow of its pricier counterpart gold, is readying itself to bask in its own substantial market attention. Economic…

-

Stalled Gold Prices at Resistance: Predicting a Bearish Continuation

In the tumultuous world of the gold market, the last several days have seen gold prices stalling at a significant resistance level. This pause in upward movement, coupled with a few key indicators, are leading some investors and analysts to question if a bearish continuation is on the horizon. Gold, characterized by its inherent volatility,…

-

Gold Price Plummets to $2,833, Mirroring Bearish Reversal Signals – Analyzing the Commodity Market

In a remarkable downturn, the gold price has plunged to $2,833, backing strong bearish reversal indicators spotted earlier. This substantial change in the gold market falls in line with historical trends, confirming the cyclical nature of the commodity and highlights potential future fluctuations. Traders must closely observe their strategies amidst such fluctuating conditions. The drop…

-

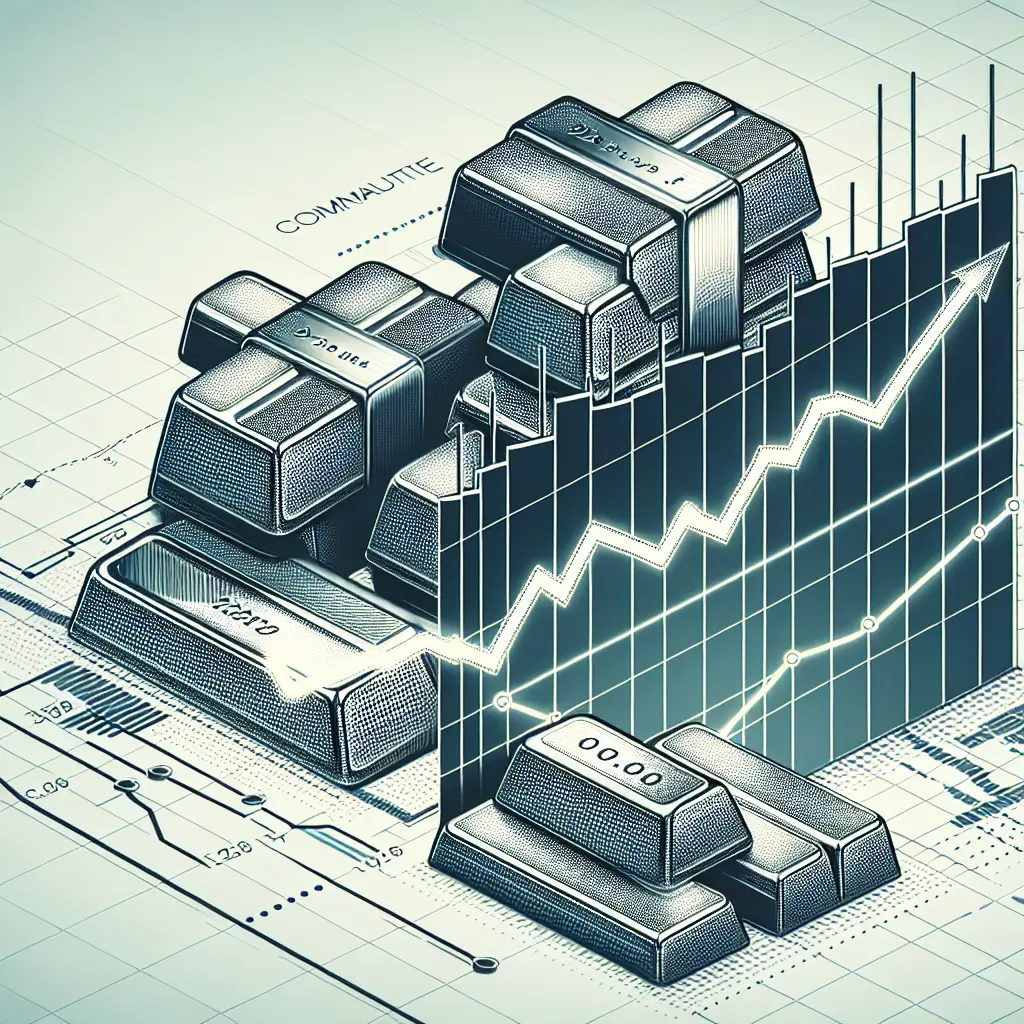

Silver Price Forecast: XAG/USD witnessing steady climb, Held Back by 100-day SMA – FXStreet

Investors are keeping a keen eye on the silver market as the XAG/USD continues to climb steadily. Supported by robust market fundamentals and increased investor interest, silver is on a positive trajectory. However, the bullish run is capped by the 100-day Simple Moving Average (SMA). Despite this cap, the upward trend of the XAG/USD underlines…

-

Silver Price Anticipates Breakout as Key Support Levels Hold Firm

Silver, the precious white metal, is showing auspicious signs of a potential breakout in its price, as bull market actors staunchly defend key support levels. This situation is driven by long-term investors, who, displaying unwavering confidence in the metal’s intrinsic value, stand firm against downward pressures. The key support levels have proven to be a…

-

Silver Continues to Withstand Pressures Above – Analyzing the Market Impact

The silver market has consistently experienced pressures from above, marking a distinctly turbulent period. Despite the headwinds, the precious metal continues to reflect a resilient spirit, hinting at underlying strengths that could potentially signal lucrative future prospects. Bullions, mining stocks, and exchange-traded products have all exhibited consequences of this pressure, but likewise also reveal silverâs…

-

Bullish Reversal Breakout: Silver Gas Price Poised For Recovery

Emerging from a period of consolidation, Silver Gas seems to be eying a progressive recovery following a bullish reversal breakout. This surge registers on the radar of major market players and denotes a promising trajectory for the metal commodity market. The predictive outcome is largely attributable to positive macroeconomic indicators acting as catalysts to this…

-

Analysing Silver Price Outlook; Silver Facing Resistance

With the ongoing uncertainties in the global economic landscape, all eyes remain on the silver markets. The precious metal, famously known as ‘poor man’s gold’, continues to display a robust resilience, seemingly unfazed by the evolving macroeconomic environment. Despite facing several near-term pressures, silver has managed to maintain its lustre, consistently looking at major resistance…

-

XAG/USD Surges Beyond 100-day SMA – A Promising Outlook for Silver Market

In light of the latest developments in the global market, silver prices have seen a notable upturn. XAG/USD, the silver-to-dollar exchange rate, has made a remarkable climb above the 100-day SMA (Simple Moving Average), shining a positive light on silver’s market status. This rise hints at potential trends in the precious metals market and could…

-

Gold and Silver Prices Reach Historical Peak – Bizz Buzz Market Updates

Today, the global commodities market has observed a remarkable fluctuation in the prices of Gold and Silver. On 14/11/2024, the price of Gold per ounce reached a historical peak, creating a buzz within the investment communities. Investors are swarming towards these precious metals as a safe haven, amidst the economic turmoil. On the other side…

-

Silver Price Outlook – Consistent Supportive Action Presents A Bright Future

Silver Price Outlook n Silver, the precious metal, continued to receive supportive action on Thursday, marking yet another day of its steady performance in the global market. This trend signifies the underlying strength in the silver market, offering considerable upside potential for investors. n nThis supportive action is driven by several factors, including inflation fears,…