Category: Finance News

-

Unprecedented Pressure on Silver Prices: Analysis by Commerzbank & FXStreet

The global marketplace witnessed a substantial flux as silver prices came under intense pressure, according to Commerzbank and FXStreet. Industry experts are linking this to several market conditions – the unstable economy, trade disparities, and fluctuating market dynamics. Amid such uncertainties, investors usually turn their eyes towards safe metals like gold and silver. However, recent…

-

HSBC Bolsters Gold Price Projections amid Heightened Geopolitical Turmoil

Amid escalating geopolitical tensions, HSBC has revised its gold price forecasts upwards. The global banking giant anticipates the yellow metal to benefit as investors flock to so-called ‘safe haven’ assets in uncertain times. Historically, gold prices rally when geopolitical risks increase, providing a cushion for investors against financial market volatility. The upsurge in gold prices…

-

Silver Continues its Steady Climb – A Look at the Current Silver Price Forecast

In a volatile global economy, silver continues to hold its own, displaying resilience and potential. The metal has demonstrated a slow, steady climb, indicative of its robust nature, and global investors are turning their attention towards it. While some market contractions have been witnessed, they are perceived as periodic adjustments typical in any thriving market.…

-

Gold Stays Near Record High With Eyes Set on Trump’s Tariff Reveal

With gold trading near its all-time high, all eyes are on President Trump’s imminent tariff reveal. Analysts speculate that any harsh tariffs could inject volatility into markets, potentially cementing gold’s reputation as a safe-haven asset. Gold has proven its resilience in the past, surviving volatility in market conditions, changes in monetary policies, and global geopolitical…

-

Missouri S&T Researcher Delves into Future of Finance with Cryptocurrency Innovations

As we delve deeper into the digital epoch, cryptocurrency continues to evolve at an astoundingly rapid pace. In an exclusive interview with a leading cryptocurrency researcher at Missouri S&T, we unpack the layers of this complex and ever-changing field. The researcher provided an in-depth analysis of the innovative technology powering cryptocurrencies, its potential impact on…

-

Gold Soars Above $3,100, Silver Eyes Breakout: KITCO

Astonishingly, gold prices have shattered previous records, soaring to an eye watering figure of over $3,100. This bull market has defied gravity, showing a parabolic trajectory reminiscent of a rocket launch. Judging from the current demand dynamics, gold is far from done impressing us. In the midst of gold’s stellar performance, silver has been quietly…

-

Becoming Gold Bugs: Investors Turn to Precious Metal Amid Uncertainties

Everyone Is a Gold Bug Now – The Wall Street Journal In an age where digital assets are gaining prominence, the traditional allure of precious metals, particularly gold, stands unperturbed. Everyone, from industry stalwarts to the novice investor, seems to be turning into a ‘Gold Bug’. The value and stability offered by gold make it…

-

Gold Surges past $3,100 as Trump’s Tariffs Trigger Metal Market Frenzy

In an unprecedented move, gold prices have surged past the $3,100 mark, as reported by Yahoo Finance. This remarkable change in the market is attributed to the tariffs imposed by the Trump administration, causing a stir among the global metal trade. Copper prices are not far behind either, hovering near their record, adding to the…

-

Record High Gold Prices as Safe-Haven Investment Surges

In a compelling turn of events, the price of gold has ascended to an all-time high, showcasing the metal’s continued appeal as a reliable ‘safe-haven’ asset, especially in periods of economic uncertainty.nnAccording to Kitco NEWS, this dramatic surge is largely due to the heightened demand amongst investors who opt to divert their investments into traditionally…

-

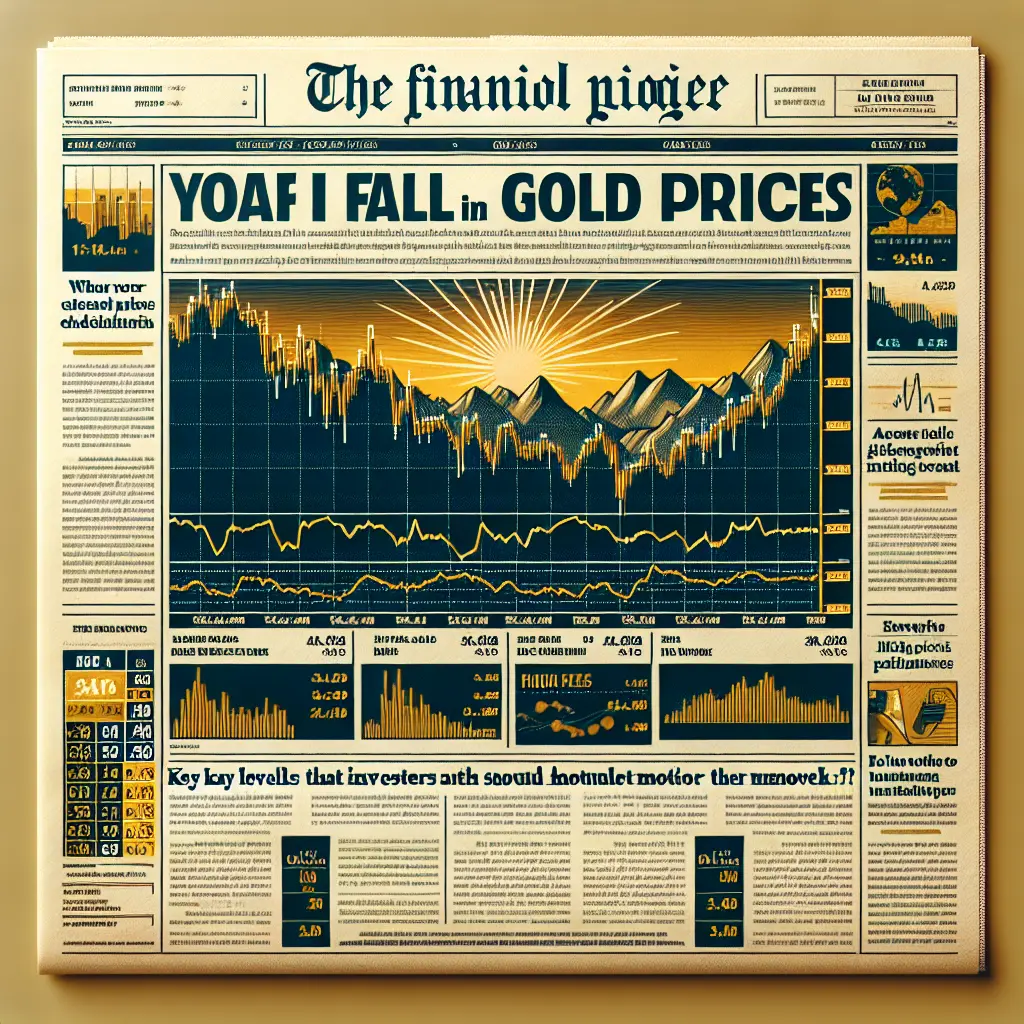

Gold Prices Dip Amid Dollar and Treasury Yields’ Rise – Analysis

The gold market has seen a slight downturn, as both the dollar and treasury yields make strides in the opposite direction. This trend paints a notable picture of the intricate relation between economic indices and global assets like gold. The strength of the US dollar and quasi-governmental securities such as Treasury yields often plays a…

-

XAG/USD Holds Steady While U.S. Economy faces Uncertainty

As the United States grapples with rising economic anxieties, the silver market remains a bastion of stability. With silver prices – denoted by the symbol XAG/USD – steadying near the $33.00 mark, investors worldwide are carefully monitoring the precious metals market. This enduring resilience amidst a fluctuating economy underscores silverâs pivotal role as a safe-haven…

-

Decline in Gold Prices: Exploring Key Factors & Crucial Levels to Monitor

Gold prices witnessed a remarkable decline last week. The golden metal’s glitter seems to have faded due to significant factors impacting the global market. The primary reasons associated with this decrease include the strengthening of the US dollar, increased bond yields, and the anticipation of global economic recovery. The US Dollar Index, which measures the…

-

Unprecedented Silver Crash: XAG/USD Dives Toward $33.00 in Major Financial Upset

Silver Price Plummets In a shocking turn of events, the price of Silver (abbreviated as XAG/USD in forex market) has suffered a major blow, crashing towards the $33.00 mark. This dramatic downfall marks the metal’s worst daily loss since February. Market analysts cite concerns over fluctuating demand and supply scenarios, coupled with volatility concerning global…

-

Gold Price Forecast: Record XAU/USD Highs After Federal Reserve Meeting

In the volatile world of international finance, the Gold Price Forecast was nothing short of spectacular in the aftermath of the Federal Reserve’s most recent meeting. XAU/USD surged to new record highs, highlighting the trend of investors flocking to safe-haven assets in times of economic uncertainty. The potency of gold as a wealth preserver and…

-

Historical Highs: Gold Price Surges Ahead as FOMC Results Awaited

In what can only be described as a historical event in the world of precious metals, the price of gold has hit an all-time high, riding on anticipation of the results of the Federal Open Market Committee (FOMC) meeting. The fervent mood in the market reflects a growing interest in safe-haven assets amidst global economic…

-

Commerzbank Foresees a Rise in Silver Prices, Predicts $35 Margin Soon

Commerzbank, one of the leading global financial institutions, has projected a grand silver outlook for 2025. The bank has elevated its silver price forecast for 2025 by 6%, stating that the $35 threshold is ‘likely to be reached soon’. This announcement has unveiled a new wave of optimism within the precious metals market. This news…

-

Silver Price Outlook – Analytics & Projections Amid Market Noise – FX Empire

Silver prices continue to remain volatile on the global front, as traders seem divided on the precious metal’s outlook. Factors influencing the price action range from global inflation concerns, rising interest rates, to geopolitical tensions. Though silver prices have shown an erratic behaviour, some analysts perceive it as a sign of a promising future. Silver’s…

-

Gold Price Surpassing $3,000: The Driving Factors

Gold Price Hits Record $3,000: Whatâs Driving The Rally? – Forbes For the first time in its history, gold has surpassed the $3,000 per ounce milestone. The unprecedented rally has been driven by global economic uncertainty, low-interest rates, and investors seeking a safe haven amidst volatile markets. Investors flock to gold in times of crisis…

-

Cryptocurrency Prices Surge Following Trump’s Endorsement of ‘Crypto Reserve’

In an unprecedented move that sent ripples through the financial markets, former US President Donald Trump backed the ‘crypto reserve’, leading to a rally in crypto prices. The endorsement is seen as a significant stamp of approval for crypto-based economies and has been hailed by supporters as a step towards mainstream acceptance. Details remain scant…

-

Silver Price Forecast: Five-Month Highs at $33.50 Level – FXStreet

In a stunning development, the Silver Price (XAG/USD) has surged to near five-month highs, reaching the $33.50 level. This impressive leap in silver prices comes on the back of increased investor sentiment coupled with strong global demand for silver commodities. The precious metal’s price has been steadily ticking upward in recent weeks, signalling an upward…

-

All-time High for Gold Price at Nearly $3,000 Amid Trade Tensions

In an unprecedented turn of events, the gold price has surged to an all-time high, nearing a staggering $3,000 as ongoing trade tensions continue to unsettle global markets. With financial moguls and investors grappling with uncertainties, gold has emerged as the asset of choice for those seeking a safe haven investment. The escalating trade disputes,…

-

Silver at $33 Cuts the Gold/Silver Ratio, As US Stocks Surge – A Rally Response to Inflation Miss

In an unexpected turn of events, the finance markets reported a substantial shift on Wednesday, 12th March 2025. Silver, having reached a notch price of $33, significantly cut down the Gold/Silver ratio. This drop in ratio is rarely seen in the market and marks a critical point in understanding the projected growth of Silver in…

-

Potential ‘Panic-Selling’ May Lead to Bitcoin Market Crash – Analysis | Forbes

As the market expands its awareness to cryptocurrency, so does its instability. Bitcoin, once the dazzling star on the currency stage has started to flicker with ‘Panic-selling’ threatening to plunge its high values into crashing lows. This news might sound catastrophic for individuals who have invested heavily into Bitcoin. Panic selling is a common reaction…

-

Bull Market Returns: Wall Street and Main Street Foresee Increased Gold Prices in the Week Ahead

After a period of sustained bearish sentiment, bull markets appear to be returning, predicting higher gold prices ahead. Both Wall Street and Main Street traders are expecting a rise in gold prices over the coming week. This has been confirmed by recent polls conducted among both retail investors and market analysts. With an overall bullish…

-

Former President Trump Sets Up US Bitcoin Reserve

In a surprising move, the Trump administration has established a Bitcoin reserve, marking a bold endorsement for cryptocurrency in the United States. The initiative, announced this week, represents a sharp pivot from Trump’s previously dismissive attitude toward cryptocurrencies. A Sudden Change in Tune While the former president famously stated in 2019 that he was not…

-

Silver Price Forecast: Experts predict robust growth for the white metal

As global economies continue to reel under the pressures of the ongoing pandemic and financial instability, experts have turned their gaze towards precious metals as a safe investment. Notably, predictions about silver’s future are turning heads. According to market experts, the white precious metal is expected to reach a remarkable â¹1.17 lakh/kg in a years’…

-

An Unexpected Debt Shock: DAX Surges, Gold Plummets in Euros

In a surprising turn of events, the DAX leaps forward while gold sinks in the wake of a debt shock. Market analysts were left scrambling as these unexpected movements shook the financial world. While the shift positively impacted DAX, causing it to leap forward, the impact on gold was the polar opposite. Experts align these…

-

Silver Price Takes a Hit amid Soaring US Dollar | FXStreet Weekly Report

Despite a promising start to the week, silver prices have taken a hit with XAG/USD dropping nearly 4% on the FXStreet index. The recovery of the US dollar, bolstered by strong economic data, has been cited as the primary factor for this downward turn. Silver started out with a healthy growth trajectory, but was swiftly…

-

Spring 2025 Gold Price Forecast: Experts’ Predictions – CBS News

As spring approaches, investors worldwide are eyeing the gold markets with anticipation. The precious metal has been on a steady incline, raising the question: will gold’s price keep rising this spring? Our experts weigh in.nn- Dr. Joseph Goldstein, a leading expert in precious metals and a professor of economics at Princeton University, predicts a continued…

-

Gold’s Price Projection: Understanding Expert Predictions for Spring 2025

As the Spring season upon us, the price of gold is once again at the center of attention. Investors around the globe are eagerly watching its performance, and the question on everyone’s mind is: Will gold’s price keep rising this spring? According to many experts, the possibility is high. Several factors are driving this optimism,…