Category: Financial News

-

Gold Firms Amid Weaker Dollar as Markets Focus on Trump’s Second Term Plans

Gold prices have been firming in the marketplace due to a softer U.S. dollar, with markets eyeing the second-term plans of former president Donald Trump, according to Reuters. Market analysts highlight a critical link between the dollar’s performance and gold prices. Gold oftentimes inversely correlates with the U.S. dollar. When the value of the dollar…

-

Gold & Silver Price Forecast: Is the Future Shining Bright?

As we step into a new era following the recent inauguration, the metals market offers a promising scene. Precious metals, specifically gold and silver, are showing strong upside potential, according to FX Empire.nnFollowing various economic instability and political uncertainty, gold and silver have consistently served as safe haven assets for investors. The inauguration has signified…

-

Gold & Silver Prices Forecasted to Reach New Heights in 2025 – Metals Daily CEO

Metals Daily CEO Ross Norman has projected a promising future for gold and silver prices in the coming years. According to him, gold is set to reach an All-Time High (ATH) of $3,175 per ounce in the coming year 2025. Parallelly, the spot silver price is also expected to break barriers and trade above $38…

-

Analysis: Bitcoin’s uptrend following the CPI Inflation Report and its implications for crypto markets

With the recent CPI Inflation Report, there’s been a noteworthy uptick in Bitcoin’s value. The correlation is no mere coincidence; CPI or Consumer Price Inflation measures the rate at which the average price of chosen goods and services increases over a while. A higher than expected reading is generally seen as bullish, or positive, for…

-

Gold and Silver Gain Traction Amid Cooler U.S. Inflation – The Role of Macroeconomics in the Metals Market

In a turnaround from recent trends, precious metals gold and silver registered mild gains following the release of lower-than-expected U.S. inflation data. The precious metal market had been closely observing the economic atmosphere, tasked with balancing concerns of dwindling supplies against persistent inflationary pressures.nnThe marginally cooler U.S. inflation data acted as the catalyst to the…

-

Stability of Gold and Silver Amid EFP Panic and US Inflation Data

Despite the ensuing panic from EFP (Exchange for Physicals), the gold and silver market displayed an unyielding demeanor against the recently released US Inflation data. These precious metals, commonly used as inflation hedges, retained their stronghold, demonstrating their persistent allure to investors during economically turbulent times. The EFP market went into a tailspin owing to…

-

Surge in Silver Price Catching Investors’ Eyes – FXStreet January 14 Report

Silver Prices Shine Brightly Today In a stunning turn of events, the price of silver has seen a significant rise today, January 14th. This surge in the precious metal’s price has caught the market by surprise but is a pleasant surprise for silver investors and traders. On FXStreet, silver is shining brighter than ever with…

-

Gold Price Predicted to Moderate in 2025, Harder To Achieve Massive Gains – Analysis

As we look ahead to the year 2025, experts are predicting a moderation in the price of gold, potentially leading to a period where massive gains are more difficult to achieve. This is in stark contrast to the previously continuous upwards trajectory of the precious metal’s value. Despite these predictions, gold remains a trusted safe…

-

Could Gold Prices Experience a 30% Decrease?

As a leading precious metal, Gold’s price fluctuation greatly impacts the global economy. Over recent years, the prices have been soaring high, but a big question now lingers: Can Gold Prices Drop 30%? Economic experts point out a few factors that could potentially cause such a significant drop. These include an upswing in real interest…

-

Gold Prices Dip After Robust Nonfarm Payroll Report

In the aftermath of a robust Nonfarm Payroll report, gold prices showed a significant decline. The U.S. Bureau of Labor Statistics’ Nonfarm Payroll report is a critical economic indicator, reflecting the evaluated change in the number of employed people during the previous month, excluding the farming industry. A stronger-than-expected report, as we saw it, translates…

-

Silver Price Forecast: XAG/USD Rises Ahead of US NFP Data

Silver Price Forecast: XAG/USD rises to near $31.30 Silver prices have seen a significant rise to near $31.30, gaining momentum ahead of the U.S. Non-Farm Payroll (NFP) data. The strong performance of the white metal suggests an optimistic outlook in the global market. Trending bullish, traders are flocking toward Silver, positioning it as a promising…

-

Gold Price Rebounds Amidst Trump Policy Uncertainties, Despite Strong US Jobs Data

Breaking news, the price of gold rebounds amidst growing uncertainty over Trump’s policies. This surprising development occurs despite the release of robust US jobs data. Analysts had been speculating that strong employment figures would dampen the investment demand for gold. However, concerns over future policy decisions by the Trump administration appear to have triggered a…

-

Silver Prices Forecasted to Soar by 20% in 2025

Silver Price Forecast The relentless growth and strong fundamental backdrop of the silver market could see prices rise by as much as 20% by 2025. According to BNamericas, the critical factors propelling the projected rise are increased demand from the jewelry industry and the booming technology sector. Furthermore, geopolitical tensions could also play a sizable…

-

Silver Price Forecast Soars Amid Weaker US Dollar – FXStreet GMN Report

Precious metals saw a significant surge in the market, with the silver price (XAG/USD) soaring above the $30.00 benchmark in a favorable trend largely spurred by a precipitous dip in the value of the US dollar. This recent turn of events has industry analysts eyeing silver as a promising investment with potential for future growth.…

-

US Economic Data Impacts Gold Prices, Leading to a Downward Trend

Global gold prices have noted a downward trend, dipping in response to the rising yields. A simultaneous anticipation of United States economic data has supplemented the market’s preparation. This dynamic is a natural consequence in the financial world, where gold prices commonly act inversely to rising yields. Several investors and market observers have their attention…

-

Market Volatility Affects Gold and Silver Prices Amid Trump Tariff Modifications

Volatility Hits Gold and Silver Prices Recently, an unexpected turn took place in the markets due to a ‘tweak’ to President Trump’s trade tariffs. This adjustment has caused significant volatility in the prices of gold and silver, two commodities often seen as safe havens during times of economic uncertainty. As a result of this change,…

-

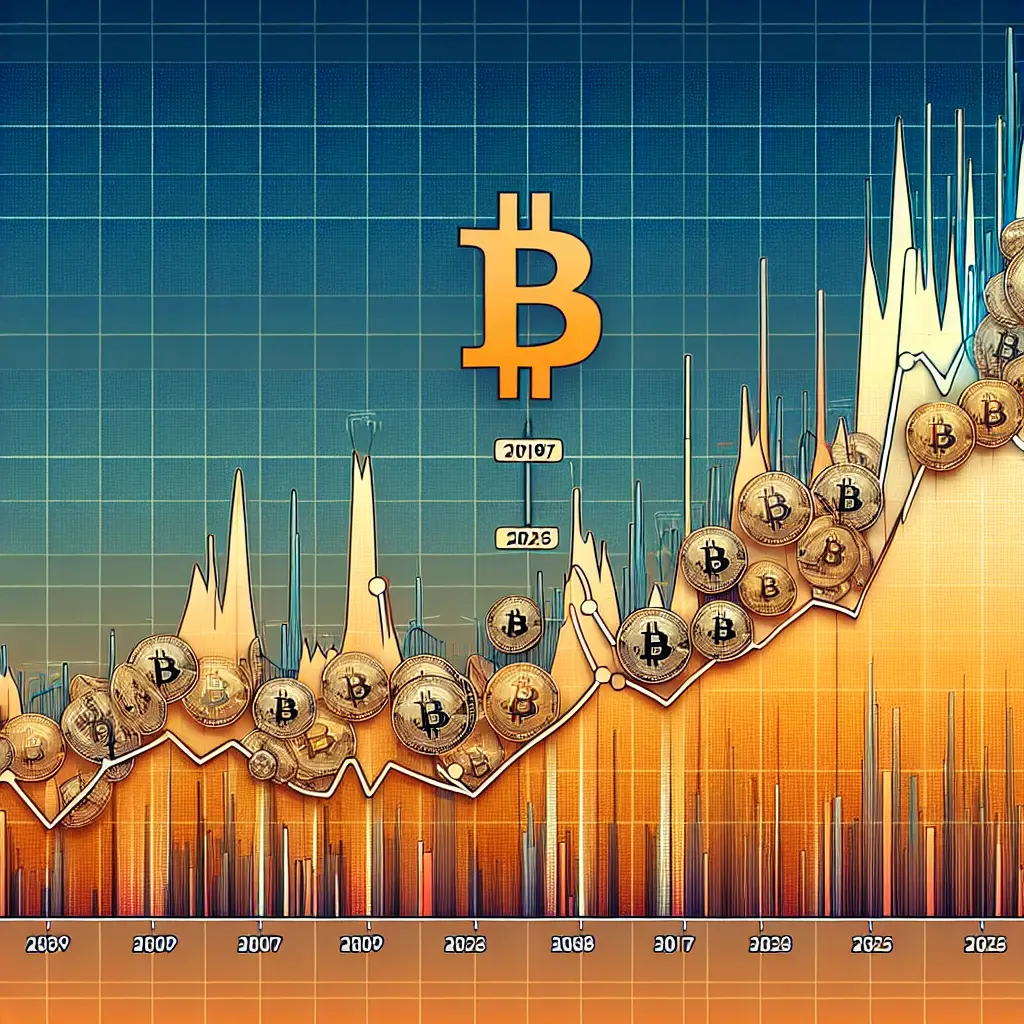

Bitcoin’s Price History: From 2009 Inception to 2025 Climax – Bankrate.com

Bitcoin, the brainchild of an anonymous programmer or group of programmers known as Satoshi Nakamoto, made its grand entrance in the financial stage in 2009. Digitally innovative, Bitcoin quickly gained traction, promising a combination of decentralization, security, and transparency. This revolutionary cryptocurrency has undergone extraordinary price trajectories over the years, reaching unprecedented peaks.nnFast forward to…

-

The Gold Bull Market Surges Without U.S. Involvement – An Unforeseen Economic Phenomenon

In an unexpected turn of events, the gold bull market has surged upward with surprising strength, in spite of the U.S. not being an active participant. Gold, traditionally seen as a safe haven in times of economic and geopolitical uncertainty, continues to climb new heights. The burgeoning gold bull run can be attributed to a…

-

Update on Gold’s Performance: A Bit of a Dip as XAU/USD Eases and Investors Diversify – FXStreet

The XAU/USD exchange rate came under some selling pressure on Friday as investors began to look elsewhere for investment opportunities. Even though Gold is often considered a safe haven, it appears that the allure of other markets was too great on this occasion. That said, this does not necessarily signal a bearish trend for XAU/USD.…

-

Silver Price Forecast Shows Sideways Movement – A Closer Look

The upcoming year is showing no definitive movement in silver prices according to latest forecasts. Market analysts at FX Empire have reported continued sideways trends, indicating an uncertain period in the commodity’s overall performance. Traders and investors are speculated to wait for a stronger prediction before making significant moves in the market. Keep watching this…

-

Gold Price Dips: Markets on Lookout for New Catalysts

In a surprising turn of events, global gold prices experienced a slight dip today. This dip comes as investors and market watchers await new catalysts that could potentially sway the market. Uncertainty abounds as speculation and analyses swirl around potential impacts this could have on the global economy. But one thing is sure, gold, traditionally…

-

Gold Price Takes a Dip: Markets Anticipate Fresh Catalysts

Gold prices dip as markets await fresh catalysts – Reuters. Markets around the world are closely observing the gold price as it saw a slight dip. Market experts and investors look for fresh catalysts pushing gold prices. Many speculate that certain economic and geopolitical events could potentially shake the market and increase the demand for…

-

Silver Price Dips Despite Geopolitical Tensions: An FXStreet Analysis

Despite the escalating geopolitical tensions that are shaking the global financial markets, the price of silver, denoted by XAG/USD, continues to suffer a setback, dropping to near $29.60. This contradicts the typical market reaction whereby precious metals such as silver and gold usually experience a surge in face of international conflict or crises. The reasons…

-

Gold Forecast: Wall Street Predicts Return to Glitter in 2025

In 2025, Wall Street analysts predict that gold will regain its shine. This comes following a tumultuous period for the precious metal throughout the 2020s. Financial experts are hinting at a resurgence, citing a variety of factors from geopolitical instability to potential currency inflation.nnPredictions hinge on the belief that investors will once again turn to…

-

Holiday Trading Sees Gold Price Holding Strong – Kitco NEWS

Despite the lull of the holiday season, the gold market has shown resilience as prices cemented a strong posture during the quieter trading sessions. This anomaly defies expectations as the market typically retreats during festive times. The firmness in gold prices suggests a sustained demand for the safe-haven asset amidst global economic uncertainties. Experts say…

-

Steady Gold Prices Despite Quieter Holiday Trade – Analysis

The holiday trading period has seen a particularly firm settling of gold prices, even during times of less trading activity. This underscores gold’s enduring value as a safe haven investment, particularly in times of global economic uncertainty. Investors have shown faith in the precious metal, leading to a sustainable growth in value, irrespective of the…

-

Money Matters: Cryptocurrency VS the US Dollar – An insightful look into the evolving world of finance

Money Matters: Crypto currency vs. the US dollar – Gold Country Media In today’s digital age, the arena of financial transactions is never constant. Traditional forms of currency, like the US dollar, now share the stage with more modern financial mechanisms: Cryptocurrencies. Cryptocurrencies like Bitcoin, Ethereum, and Lite coin have been erupting on the financial…

-

Steady Gold and Silver Prices Over the Holidays – Market Insight

Despite an air of calm encompassing the financial markets during the holiday season, gold and silver showing steady price action. A holiday trade can often be absent of significant news events and sharp fluctuations, and this season seems to fall in line with that trend. nn Gold and Silver performances, in particular, have been noteworthy…

-

Silver Price Resistance Test – Daily Forecast | Economies.com

With the dawn of Monday, 23rd December 2024, silver prices showed a significant test to the resistance levels. The metal’s price pressure is an evident reflection of the current macroeconomic climate. The ongoing global financial discussions, coupled with the investment strategies of the corporate world, have pushed this precious metal’s price to contentious lines. Expert…

-

Silver Markets Vulnerable Below $30: XAG/USD Price Forecast

In a year marked by economic uncertainties, the silver market experienced mirrored turbulence. The state of the silver market, specifically the XAG/USD pair, exemplifies the broader trends within the volatile commodity markets. As of our update, the XAG/USD pair retains a negative bias below the $30.00 threshold. This bears a testament to the persistent challenges…