Tag: Commodities

-

Silver’s Strategic Significance – A Matter of National Security

Traditionally seen merely as a precious metal for jewelry and investment, silver is now emerging as a critical element in the national security arena. Poised on the brink of a new industrial revolution, the demand for silver in technological applications has been steadily rising. This, coupled with the depleting reserves, has signaled a significant shift…

-

Gold Price on January 6, 2026 | Commodities Update | Fortune

In the world of commodities, gold is always a hot topic. As of January 6, 2026, the current price of gold stands out for its stellar performance. The precious metal continues to hold its ground amidst a turbulent market. Investors are pinning their hopes on gold as a safe haven, biding their time until the…

-

Latest Silver Price Update – Fortune

Current Price of Silver as of December 30, 2025 The current market price of silver as of Tuesday, December 30, 2025, displays a significant move in the commodities market. In response to various global economic climate indicators, investors are showing renewed interest in silver as a safe-haven asset. Stay tuned for the latest updates and…

-

The Gold Rally of 2025: Causes and 2026 Outlook

In an unprecedented rally, Gold price has surged past the $4,500 mark in 2025. The steep rise can be predominantly attributed to the roaring comeback of ETF inflows which had been sluggish in the previous years. The sudden influx can be traced back to uncertain global economic conditions that brought investors back to the traditional…

-

Gold Price: Expect The Glitter to Continue Despite Massive Gains in 2025

Gold Price to Sparkle Anew Despite witnessing its most substantial gains since 1979, experts in the field of mining anticipate that gold will continue its shining streak in the coming year as well. This year’s unprecedented escalation in gold prices, attributed to global economies grappling with unprecedented challenges, was an unexpected boon for this precious…

-

Gold Price Falters in Wake of Federal Reserve Rate Cut

As the market adjusts to the recent Federal Reserve rate cut, the price of gold has seen a mild decline. The precious metal, often viewed as a safe haven in times of economic unpredictability, has trailed off as investors reassess their positions. The Fedâs decision to trim rates was aimed at stimulating economic growth, which…

-

Metal Markets Alert: Gold & Silver Prices Stagnate Ahead of Influential Economic Reports

Gold (XAUUSD) & Silver Price Forecast: Metals Stall Ahead of ADP Jobs and PMI Reports – FXEmpire Published on Tue, 04 Nov 2025 07:15:00 GMT The global gold and silver market are awaiting results of the crucial ADP Jobs and PMI reports. Analysts predict the results of these reports could potentially set new directions for…

-

Gold Price Forecast: Surge to Near $5,000 an Ounce Within 12 Months

The global gold industry is witnessing a surge in prices, projected to nearly reach the $5,000 mark per ounce within the next 12 months. This trend reflects upheavals in the macro-economic landscape and increased demand for the precious metal as a safe-haven asset. According to a recent Reuters report, industry professionals anticipate the price hike…

-

Current Price of Silver as of Monday, October 6, 2025 – An In-depth Analysis

Current Silver Prices: A Comprehensive Overview Silver, a much-prized commodity, has seen a flurry of activity in recent months.The current price of silver, as of Monday, October 6, 2025, marks an important milestone in its market performance. The continuous fluctuations are widely debated by investors, with market experts forecasting a promising future for the white…

-

Momentum Continues For Silver: Price Outlook Analysis – FXEmpire

In the world of precious metals, silver continues to demonstrate a strong momentum, thriving on robust demand. While gold has often been the centerpiece, silver has surprisingly stolen the spotlight with its impressive appreciation. Silver’s current momentum can be attributed to a multitude of factors, including inflation fears, the weaker dollar, and investment demand. As…

-

Gold Prices Dip Ahead of Federal Reserve Rate Verdict

As anticipation ramps up ahead of the Federal Reserve’s pending rate verdict, gold prices have witnessed a slight retreat from their recent record highs. This momentary downturn does not reflect poorly on the precious metal’s overall performance. On the contrary, the retreat confirms the inherent volatility of the gold market, a characteristic that also lends…

-

Silver’s Momentary Pause: An Insight Into Silver Price and Outlook on FXEmpire

Silver Price Outlook â Silver Pauses Early on Monday – FXEmpire In the early hours of Monday trading, Silver demonstrates a fleeting pause, offering investors a brief momentary respite in an otherwise volatile market. This pause is a repercussion of various global economic landscapes and prospective forecasts that influence the value of not just Silver,…

-

Gold & Silver Price Forecast: Can $3,230 Hold or Will It Break Below $3,200?

Gold (XAUUSD) & Silver Price Forecast: $3,230 Holds as Bears Eye Break Below $3,200 The world of gold and silver trading is laden with intense suspense. Today, the gold price is barely holding at $3,230. This is a pivotal moment for traders, as a potential price drop below $3,200 appears to be on the horizon.…

-

Silver Market Analysis: Maintaining 20-Day Support Amid Upswing, Risks Pullback

Despite an uptrend over the course of the past twenty days, the price of silver has managed to sustain its 20-day support. However, experts warn of potential pullback risks. The precious metal, often used as a hedge against inflation or uncertain times, has seen a positive trend recently, possibly due to investor sentiments and demands.…

-

Gold and Silver Price Forecast Amid Tariff Tensions

The global marketplace is currently witnessing volatile changes as tariff tensions escalate, and the strength of the dollar ebbs. This precarious scenario has been serving as fuel for a rising demand for safe-haven assets among investors, most notably gold (XAUUSD) and silver. The heightened trade-related apprehensions paired with currency debilities have cast a shadow over…

-

Market Suspense: Gold Prices up Modestly as Traders Await News – KITCO

With thin air of anticipation hovering over the market, mild fluctuations are seen in gold prices as traders eagerly anticipate fresh, market direction-giving news. Mirroring this trend, KITCO reports a modest hike in the golden metal’s price. This comes as no surprise to those familiar with the industry, as it’s renowned for its readiness to…

-

Gold hits record-high as US-China trade war escalates

The gold price has reached a new all-time high, with it now valued at over $3,230 per ounce. An escalation in the trade war between the United States and China has lead to an increased demand for the precious metal.## A Safe-Haven for Investors Gold is often considered a ‘safe-haven’ asset. In times of economic…

-

Silver’s 18% Drop: A Bump in the Bullish Trend?

Silver prices experienced a dramatic fall in the global markets, with an astonishing 18% drop, posing a threat to its gleaming bullish trend. nn This substantial drop sends shivers down the robust growth that silver has been experiencing over time. Once seen as an oasis of steady profits by savvy investors, the recent plunge sparked…

-

Gold/Silver Ratio at an All-Time High as Silver Price Takes a Dive – Commerzbank’s Report on FXStreet

In a startling turn of the financial tides, the price of silver has seen an unexpected plummet, further bolstering the Gold/Silver ratio to 100, according to the latest findings of Commerzbank and reported by FXStreet. Economists and investors are grappling to understand and navigate the atmospheric rise in Gold prices juxtaposed against the corresponding and…

-

Market Shrink – Silver Price Forecast: Silver Suffers Another Drop

As per the latest market updates, the price of silver took another plunge this Friday. After a brief period of stability, the fall has brought about more uncertainty in the market. Investors and market speculators are left recalculating their strategies as the day ends in significant losses. The plunge has once again spotlighted silver’s unstable…

-

Silver Price Slumps Below $32: Implications of ‘Buy the Rumour, Sell the News’

In a striking turn of events, the XAG/USD pair, primarily representing the cost of Silver, has taken a dire dip below the $32 mark. This price slump is largely attributed to the investment maxim ‘Buy the Rumour, Sell the News’, a widely acknowledged practice where investors capitalize on speculations prior to significant economic news, only…

-

Gold Price Sets New Record, Surging Past $3,100, while Silver Eyes Breakout

Gold price soars to a record high In an extraordinary turn of events, the gold price has smashed all records by crossing the $3,100 mark. This astronomical rise is shown to defy gravity, reinforcing the status of gold as the ultimate store of value. Investors and gold enthusiasts are taken aback by this parabolic rally,…

-

Gold Displaying Resistance Amid Modest Intraday Upticks; Maintains Position Above $3,000

While the trend has been for gold prices to soar, Tuesday’s trading highlights a struggle for the precious metal in carrying its intraday gains. Nonetheless, gold remains resolute, holding its place above the $3,000 mark on FXStreet. This steadfastness, despite not being able to significantly scale up, demonstrates the robust nature of the yellow metal…

-

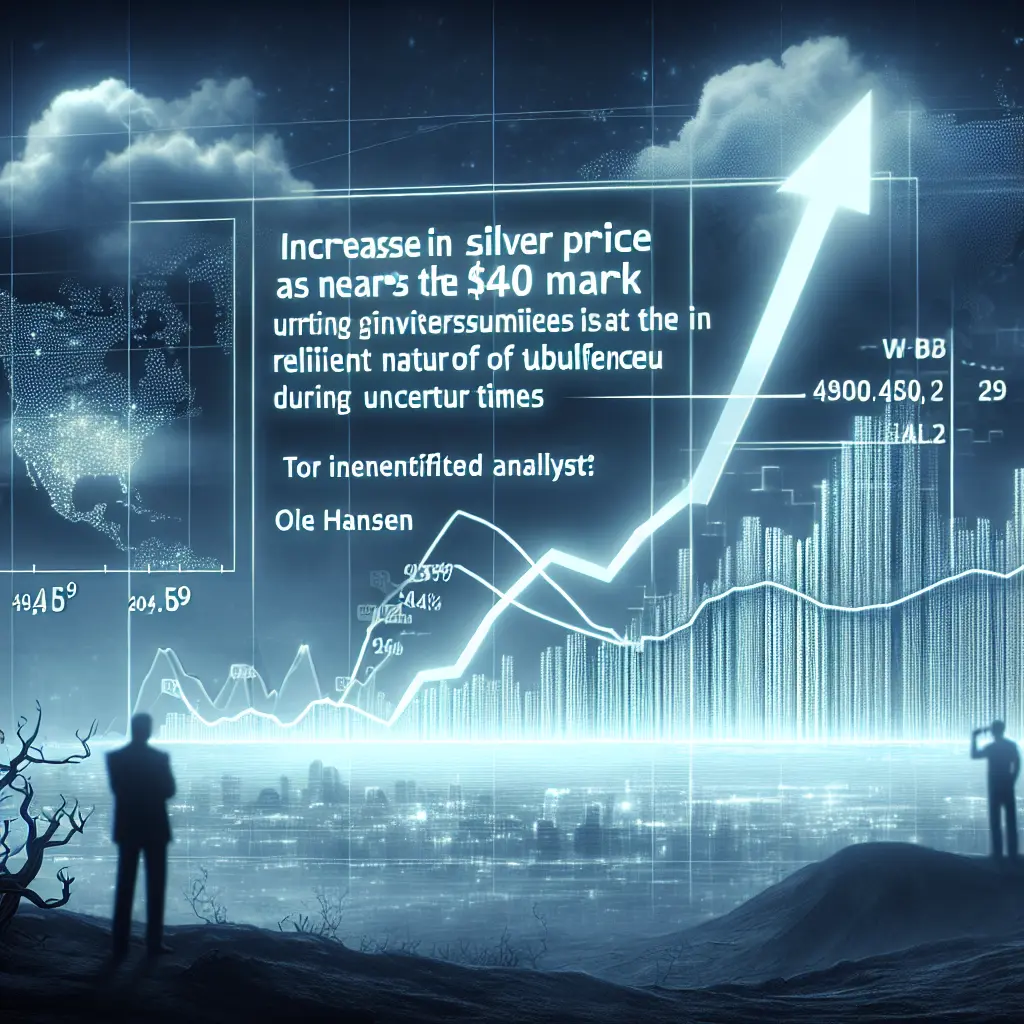

Silver Price Eyes $40 Amid Tariff Uncertainties and Market Volatility – Saxo Bank’s Insight

Despite the cloud of tariff-related uncertainties and near-term market volatility, the silver market still maintains a glittering outlook. The precious metal continues to lock its sights on the $40 price point, as per the recent analysis by Ole Hansen, Saxo Bank’s Head of Commodity Strategy. Silver’s resilience in the face of global economic instability highlights…

-

Gold Price Nears $3000 Mark as Empire State Survey Drops to -20

As global economic indicators fluctuate, there is a golden opportunity on the horizon. According to the latest Empire State Survey, a key measure of economic health has dropped to -20. This change in the financial tides has resulted in gold price being within the striking distance of $3000. Experts are optimistic about the bullish trend…

-

Silver Price Consolidation: An Early Friday Trading Analysis – FX Empire

In the early part of Friday trading, the silver market has observed a minor consolidation phase. Following a trend of resilient performances, the precious metal seems to be taking a breather, tightening its grasp in the market. This trend is consistent with market predictions and expert forecasts that project bullish prospects for silver. However, it…

-

The Potential Risks in the Dazzling Rise of Gold Prices

In the high stakes game of commodities trading, gold has always held a special position. As a traditional buffer against inflation, gold is set to close at a record price, sending waves of excitement through the markets. However, potential buyers should be wary of the associated risk factors. The ebb and flow of the market…

-

Gold Price Forecast: Dramatic Rebound but Fear of Bearish Retracement Looms

Gold Price Forecast: Rebounds, But Bearish Retracement May Resume Below $2,894 Amid a volatile climate, gold prices have had quite a dramatic ride. Lucky for investors, they have rebounded after a bearish retracement. Despite that, expert analysis remains cautious, predicting the bearish retrace pattern could resume if gold prices drop below the $2,894 mark. This…

-

Analyzing Recent Gold Price Dip and The Potential Buying Opportunity Post Trump-Zelensky Meeting

The price of gold has slipped significantly by â¹2350 from its record high, coinciding with the US dollar reaching a two-week peak. This unexpected shift in the market has left investors pondering their course of action, particularly in the aftermath of the much-anticipated meeting between President Donald Trump and President Volodymyr Zelensky. Investors are urged…

-

Analysis on Gold Price Drop: More Profit-Taking, Weak Long Liquidation – Kitco NEWS

In a surprising turn of events, the gold price experienced a notable downturn. This financial movement comes as both more profit-taking and weak long liquidation are in play. With investors choosing the time to cash in on their gold investments, coupled with a considerably weak long liquidation, has put additional pressure on the gold price.…