Tag: Finance

-

Trajectory of Silver: Steady Ascent Amidst Market Fluctuations

Despite any prevailing economic uncertainties, the future for silver continues to shine brilliantly. In the midst of a fluctuating market, silver steadily sustains an upward trajectory, proving its enduring value as a cherished precious metal. The trend is undoubtedly on the rise, with prices grinding higher over the course of the recent period. Key market…

-

Tariff Threats by Trump Shakes Crypto Market – Impact Reflects on His Meme Coin

With former U.S President Donald Trump’s pronouncement of imposing tariffs yet again, cryptocurrencies took a hit, witnessing a shocking plunge in their prices. The unexpected fallout did not spare even Trump’s own meme coin. The hint of these tariff threats has led to an ambience of uncertainty among cryptocurrency traders and investors worldwide. As tariffs…

-

Gold Nears $3,000: Top Reasons to Invest

As the yellow metal gold increases its allure on the global economic stage, it is gradually inching closer to the $3,000 mark. This article explores three compelling reasons for investing in gold, now more than ever. 1. Inflation Hedge: In the wake of unprecedented stimulus packages released globally, inflation fears loom large. Gold has traditionally…

-

Cryptocurrency News Update: FTX Repayment and Strategic Fundraising

In the dynamic sphere of cryptocurrency, significant developments have recently occurred. One of the preeminent cryptocurrency exchange platforms, FTX, has successfully repaid its creditors, in a move that signifies the platform’s financial stability and responsible management practices. Furthermore, a new strategic initiative has been instrumental in raising substantial funds. This cogent strategy is a testament…

-

Record Gold Price Surge: When should investors sell for profits?

Gold is yet again proving its worth as a safe-haven asset, with prices hitting a record high recently. The historical and cultural appeal of gold, coupled with its inherent scarcity, make it a highly sought after investment option. So, when exactly should investors capitalise on this golden opportunity? The best advice is to be attentive…

-

Goldman Sachs’ Surprising Prediction for Gold Prices in 2025 – TheStreet

In an unexpected turn of events, Goldman Sachs has issued a surprising prediction about the gold price for the year 2025. Gold, which has always been a safe haven for investors during times of economic uncertainty, is set to see a drastic change in value, according to the financial giant. Goldman Sachs’ analysts have used…

-

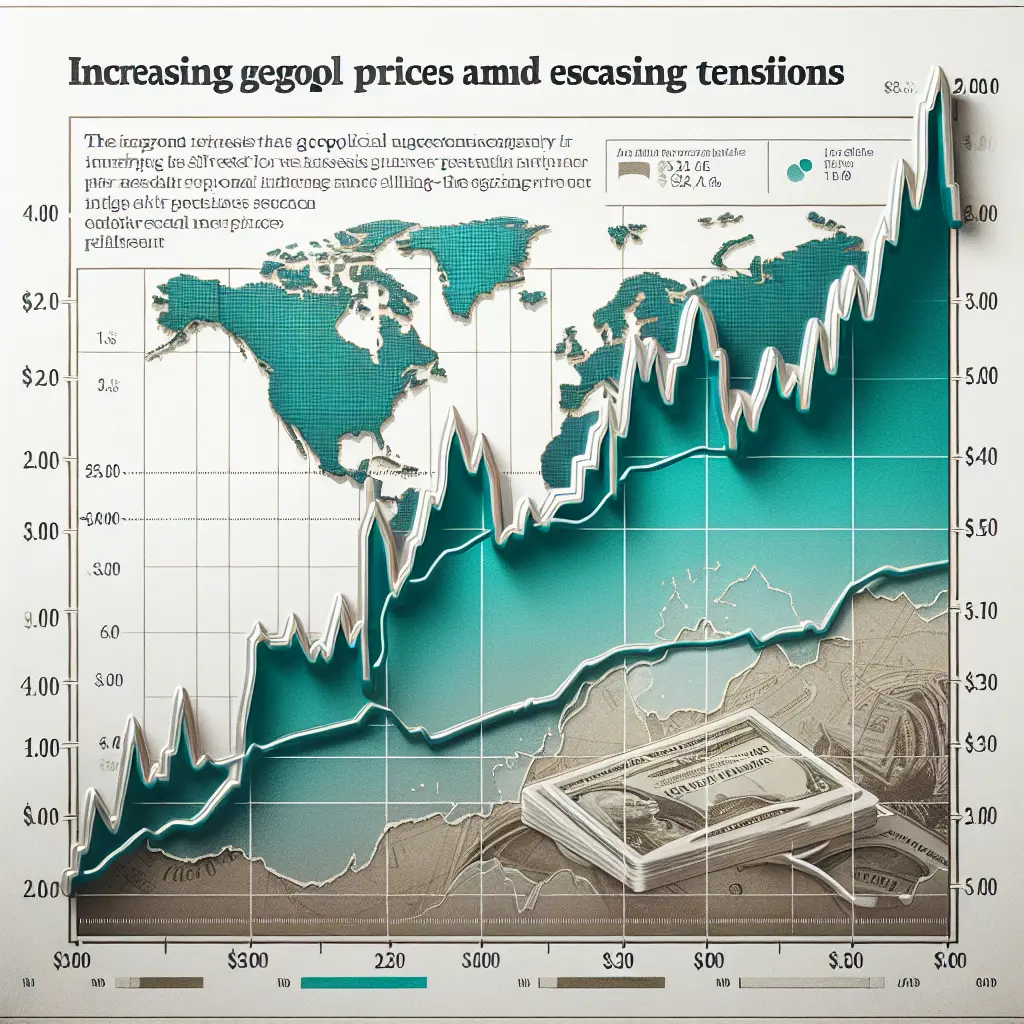

Gold Prices Surge 45% in a Year Amid Global Uncertainty; Potential for Further Rally

It is no secret that gold has always been a preferred safe-haven asset for investors worldwide, especially amid global economic uncertainties. In the last year alone, the price of gold has witnessed a monumental surge of 45%. Such bullish sentiment is primarily due to fluctuating market volatilities and geopolitical tensions, encouraging investors to hedge their…

-

Uncovering 2025’s Best Crypto Stocks – The Motley Fool

Welcome to the future of cryptocurrency trading, courtesy of February 2025. As we navigate this brave world of digital assets, let’s talk about the best crypto stocks of the month: Firstly, letâs introduce Bitcoin Solutions Inc. A stronghold in the market, it has continued its upward trend, making it an unmissable asset for potential investors.…

-

Silver Market Soars: Price Rise on February 20th – A Comprehensive Analysis by FXStreet

Precious metals have always played a pivotal role in shaping the world economy, and silver is no exception. Today on February 20th, 2025, the silver market is experiencing a sizable increase. Globally, investors are showing greater interest in this affordable yet profitable investment avenue. This rise is speculated to bring about a positive change in…

-

Surprising Gold Price Estimate for 2025 Released by Goldman Sachs – TheStreet

In an unexpected move, Goldman Sachs, a leading global investment banking, securities, and investment management firm, has released its gold price target for the year 2025. ‘Our analysts have carefully evaluated the global economic landscape and ongoing financial stability. As a result, we’ve revised our gold price estimate for the year 2025,’ said a spokesperson…

-

Silver Market Experiences Continued Choppy Behavior – An In-depth Analysis & Forecast

The recent trends in the global commodities market depict a picture of volatile activity, and silver has been no exception. The silver market continues to experience significant swings, demonstrating a phenomenon experts call ‘choppy behavior.’ Amidst a backdrop of global market uncertainty, this choppiness is expected to persist in the near future. Despite the instability,…

-

Coinbase Bulls Despite Stock Decline After 2 Pricing Target Bumps

Coinbase, a leading digital asset exchange company, recently received two price target bumps from respected Wall Street analysts. Despite this seemingly positive news, Coinbase’s stock has been observed falling. The reasons behind this counter-intuitive trend might be multifaceted. nnFinancial markets are complex entities, heavily influenced by not only financial health and outlook of corporations, but…

-

Bullish Charts and Surge in Safe-Haven Bidding Boosts Value of Gold, Silver

Gold, Silver Sharply Up on More Safe-Haven Bidding, Bullish Charts – Kitco NEWS In a significant turn of events, the value of gold and silver rose sharply, illustrating a buoyant trend in the precious metals sector. The sudden surge is thought to be encouraged by an increase in safe-haven bidding tied with bullish charts promoting…

-

Goldman Sachs Foresees Gold Price Hike Amidst Fear of Trump Tariffs

As the world continues to grapple with economic uncertainties, glimpses of brightness emerge in the form of gold. This precious metal has historically held value and now, it is set for more price gains, according to leading global investment banking, securities, and investment management firm, Goldman Sachs. With the looming fears of tariffs under the…

-

Governments Making Moves in Crypto Industry – The Future of Cryptocurrency

As the world becomes increasingly digital, crypto assets are gaining more traction. Although they were initially met with skepticism, the unprecedented growth of cryptocurrencies has prompted governments worldwide to take notice. Regulators have begun formulating legal frameworks to govern this nascent industry. Some countries, like El Salvador, have gone as far as adopting Bitcoin as…

-

Buoyed by GameStop and Coinbase, Bitcoin Ticks Up – Barron’s

Bitcoin, the shining star of the cryptocurrency world, is showing an upward trend today, with credit going to America’s popular cryptocurrency exchange Coinbase and digital gaming retailer GameStop. Bitcoin, known for its volatile nature, enjoyed a healthy increment in price that served as a hot topic in the world of technology and finance. The surge…

-

Silver Price Forecast – Silver’s Breakout Leads to an Exciting Race in the Precious Metal Market

The precious metal market witnessed an unexpected surge on Friday as Silver prices broke out, leading to increased interest and a bullish market sentiment. Silver’s performance has reiterated its strong position amidst both economic highs and lows, validating its potential for those interested in diversifying their trading portfolio. Also, the market eagerly anticipates future trends…

-

Coinbase Regains Market Share, Decreasing Robinhood’s Dominance

Following a period of stark competition, Coinbase, the prominent cryptocurrency exchange platform, regains advantageous territory in the volatile world of crypto trading. It reports a regain in market share, previously lost to Robinhood. With an impressive surge of trading volume, Coinbase makes a bold move that showcases its ongoing resilience amidst a fierce battle in…

-

Gold, silver, platinum and palladium forecasted prices in 2025 – BullionVault

As we step into the year 2025, global economic uncertainties and the ongoing geopolitical tensions are driving investor interest towards the safe haven of precious metals, namely, gold, silver, platinum, and palladium. The demand for these metals are expected to rise substantially due to their scarcity and broad industrial usage, especially in the growing field…

-

Gold and Silver Prices: A Temporary Halt or a Cause for Concern?

In the world of precious metals, the performance of gold and silver are catalysts for global economic sentiments. Recently, gold’s rally has surprisingly stalled, whilst the silver price appears to have hit a brick wall. This unexpected pause in ascend of these valuable metals has raised eyebrows among investors and constitutes substantial deliberations about what’s…

-

Gold’s rise and why gold mining stocks could be a more profitable bet

In recent months, we have witnessed a surge in gold as an investment option, fervently capturing the global attention owing to its sturdy safe-haven appeal. However, industry experts postulate that gold mining stocks could potentially present an even more enticing investment prospect. It’s important to comprehend that gold’s value doesn’t operate in a vacuum, but…

-

Gold Approaches Milestone Amid Rising Bearish Sentiments

As the financial markets shine with the glimmering allure of new gold milestones, a shadow looms on the horizon as bearish sentiments rise. The precious metal, currently perched at a tantalizing peak, is embodying the dual nature of opportunity and risk. Experts are watching with bated breath, their eyes reflecting the luminous allure of gold,…

-

Gold Experiences Brief Dip Amid Rising Profits, Anticipates Seventh Consecutive Weekly Gain

Gold dips on profit-taking, still eyes seventh weekly gainnnIn a development reminiscent of its remarkable bullish trend, gold prices showed a fleeting dip on Friday as investors engaged in profit-taking. Looking to capitalise on recent gains, the smart choice of locking in profits triggered a brief descent in the price.nnHowever, this transitory dip is not…

-

President Trump’s Trade Standoff Affects Cryptocurrency Values

Yesterday, cryptomarket experienced a fierce jolt as President Trump’s trade war threats began to rattle investors. The volatile market, already susceptible to geopolitical shifts, reacted violently to the possibility of heightened tariffs. Following the President’s announcement, the market saw a significant sell-off, with digital currencies tumbling as investors looked to safer havens. Bitcoin, the largest…

-

XAG/USD Gains Amid Middle-East Tensions – Silver Soars to Near $32.00

With rising tensions in the Middle-East, the XAG/USD pair witnessed a significant surge, rising to a near historical high of $32.00. Silver, often viewed as a safe haven asset during turbulent times, seems to be benefiting from geopolitical uncertainties. The escalation in the Middle-East and its potential implications on the global economy have prompted investors…

-

Gold Prices Today: Dip after Record Surge. Is Another Rise Looming?

In an unforeseen twist, gold prices today recorded a significant decrease following an all-time high streak. Investors are left puzzled, wondering whether gold will once again ascend in value. The key factors contributing to the gold price fluctuations include global socio-economic landscapes, investment market trends, and supply-demand chains. Analysts forecast varied scenarios. Most agree that…

-

Exploring Cryptocurrency’s Impact across Various Economic Sectors – New York Times Report

In an era of rapidly advancing technology, cryptocurrencies have managed to carve a niche for themselves. Over the past decade, they have transformed from being a puzzling novelty into a key player within the global financial landscape. However, much mystery still surrounds these digital tokens, especially in regards to their complex connections with other economic…

-

Surging Dollar & Gold amid Tariff Threats, Cryptocurrency Faces High Sell Pressure

In an unpredictable turn of events, the dollar and gold prices have surged due to increasing tariff threats. As these traditional safe havens strengthen, contrarily, the crypto market is experiencing its largest sell pressure yet. Analysts anticipate greater inflation and a slower economic pace which could further aggravate the sell-off in the cryptocurrency market. The…

-

Gift of Trump Tariffs & Inflation, Gold and Silver ETF Outflows Cease as Lease Rates Surge

In a surprising turn of events, former President Donald Trump’s tariffs, coupled with rising inflation projections, have given a much-needed fillip to gold prices. In addition, the stop in outflows from gold and silver Exchange-Traded Funds (ETFs) as lease rates surge, has further bolstered these precious metal rates.nn##Trump Tariffs and Inflation Drive GoldnnSince forever, gold…

-

Silver Market Critical Juncture: Key Resistance and Potential Pullback – FX Empire Analysis

Despite its recent rally, the silver market seems to be at a crucial juncture as it’s facing key resistance. The precious metal, often seen as a safe-haven asset, could be signaling a possible pullback in the near-term. Analysts at FX Empire note that the silver market is at a pivotal point, expressing concerns that the…